Exam Details

Exam Code

:1Z0-1056-23Exam Name

:Oracle Financials Cloud: Receivables 2023 Implementation ProfessionalCertification

:Oracle CertificationsVendor

:OracleTotal Questions

:186 Q&AsLast Updated

:Mar 22, 2025

Oracle Oracle Certifications 1Z0-1056-23 Questions & Answers

-

Question 171:

Your organization has decided to use the Portal Upload delivery method for some of their customers. You will be using this in place of other options, such as Print Email, or XML to deliver customer invoices.

Which step must be performed in the system to deliver transactions to your customers by using the Portal Upload method?

A. Select Portal Upload as a delivery method on Customer Profile under Statement and Dunning.

B. Create a custom preferred delivery method in the Manage Receivables Lookups task in Functional Setup Manager.

C. Select Portal Upload as a delivery method on Customer Profile under Invoicing.

D. Run the Create Customer Statement process in Scheduled Processes.

E. Create a custom-preferred delivery method in the Manage Receivables System Options task in Functional Setup Manager.

-

Question 172:

As an implementer. while importing data from a legacy/third-parly system, you forgot to populate the accounting distribution in the RA_INTERFACE_DlSTRIBUTIONS_ALL table. What happens when you run accounting?

A. Invoice will get created but accounting will not be created.

B. It will return an error and the data will be stuck in the interface table.

C. Invoice will be created and the system will use the AutoAccounting configuration to create accounting.

D. Neither invoice nor accounting will be created.

-

Question 173:

When deciding how to set up the system to recognize revenue, it is important to understand the extent of revenue deferral and the subsequent timing of revenue recognition.

Which two statements are true when you consider that recognition depends on the nature of the contingency?

A. Payment-based contingencies do not always require payment before the contingency can be removed and revenue recognized.

B. Post-billing customer acceptance clauses must expire (implicit acceptance), or be manually accepted (explicit acceptance), before the contingency can be removed and revenue recognized.

C. Pre-billing customer acceptance clauses require the recording of customer acceptance in the feeder system, or its expiration, before importing into Receivables for invoicing. Customer acceptance or its expiration must occur before the contingency can be removed and the order can be imported into Receivables for invoicing.

D. Time-based contingencies can expire, but the contingency will have to be removed manually before the revenue is recognized if payment is not due yet.

E. Time-based contingencies must not expire before the contingency can be removed and revenue recognized.

-

Question 174:

it has been decided that when processing customer payments using lockbox one customer can pay for another customer's transaction.

Which two steps will help achieve this?

A. Select the Allow payment of unrelated transactions Receivables System Option.

B. Define a relationship between the two customer accounts.

C. Define a netting agreement between the two customer accounts.

D. Define a business purpose of invoice to each customer address.

E. Define and share a cash pool bank account between the customers.

-

Question 175:

Your organization is looking to adopt a flexible approach to control the creation of claims investigation when the lockbox files contain invalid positive remittance references. This feature helps manage lockbox files that encounter invalid transaction numbers for receipts with customer assignment.

When this option is enabled in the Manage Receivables System Options task, which process must be run in Scheduled Processes to process Lockbox Receipts with invalid transaction referenced?

A. Process Receipts and Remittances through Lockbox

B. Process Lockbox Receipts

C. Process Lockbox Receipts and Remittance References

D. Process Receipts through Lockbox

-

Question 176:

You are reviewing an invoice on the Review Transaction page. After clicking the Sales Credit subtab. you notice the following breakdown: Revenue Allocation and Nonrevenue Allocation. What is Nonrevenue Allocation?

A. Sales credit allocation based on billing corrections

B. Additional incentive-based sales credits

C. Sales credits associated to deferred revenue

D. Sales credit reversals due to credit memo creation

-

Question 177:

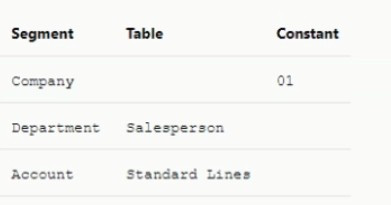

The AutoAc counting rule for the Revenue account is defined as follows:

When entering a manual invoice, the revenue account code combination is incomplete with the Department segment left blank. Which are the three reasons for this?

A. Revenue Reference Accounts for Salesperson were not defined for the Transaction Business Unit

B. Transaction Type was defined as Overapplication set to Yes but Post to GL set to No.

C. Salesperson is not required on the transaction and is left blank.

D. Revenue Reference Accounts were entered for all salespersons.

E. No Sales Credit salesperson has no reference accounts.

-

Question 178:

When entering the Customer import upload spreadsheet, which two columns, if populated with *NULL will remove the existing values on loading?

A. First Review Date

B. Credit Review Cycle

C. Order line Credit Limit

D. Credit Limit

-

Question 179:

Manage Receipt Classes and Methods

Scenario

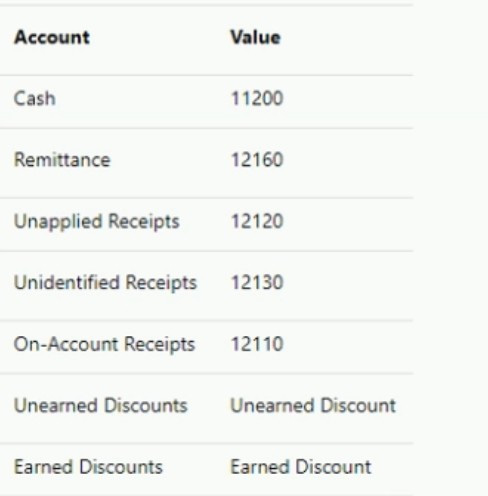

Supremo US Business unit needs to capture customer payments that will be reconciled in the Cash Management application. You need to define a receipt class and receipt method, and assign the appropriate bank account to meet this

requirement.

Task:

Define Remittance Bank Account where:

1.

Bank Account is associated with Receipt Method

2.

Primary bank account is linked the Denver branch of Bank of America Bank account number ends with 2870

3.

Remittance bank account is effective as of January 1, 2023

4.

GL Accounts section must contain the values below for company segment 120 Supremo Fitness

A. See the explanation below for solution.

B. PlaceHolder

C. PlaceHolder

D. PlaceHolder

-

Question 180:

Manage Transaction Types

Scenario

A US based company acquired on January 1. 2023. requires Supremo US Business Unit to capture invoices in Oracle Financials Cloud.

Task:

Define a new Transaction Type for the class invoice, where:

1.

Name of the transaction type is XXinvoice (Replace XX with 03.which is your allocated User ID.)

2.

Customer bills assigned to this transaction type must be printed Transaction type is meant for billing transactions With open balances Balances need to be maintained for invoices associated with this transaction type

3.

Freight charges must be allowed

4.

Cash applications to invoices assigned to this transaction type must not exceed the invoice balance due

5.

Invoices associated with this transaction type must be accounted for in the General Ledger application.

6.

Revenue GL account 41000 should be assigned as a reference account for the business unit in question and the company segment must be 120 Supremo Fitness

A. See the explanation below for solution.

B. PlaceHolder

C. PlaceHolder

D. PlaceHolder

Related Exams:

1Z0-020

Oracle8i: New Features for Administrators1Z0-023

Architecture and Administration1Z0-024

Performance Tuning1Z0-025

Backup and Recovery1Z0-026

Network Administration1Z0-034

Upgrade Oracle9i/10g OCA to Oracle Database OCP1Z0-036

Managing Oracle9i on Linux1Z0-041

Oracle Database 10g: DBA Assessment1Z0-052

Oracle Database 11g: Administration Workshop I1Z0-053

Oracle Database 11g: Administration II

Tips on How to Prepare for the Exams

Nowadays, the certification exams become more and more important and required by more and more enterprises when applying for a job. But how to prepare for the exam effectively? How to prepare for the exam in a short time with less efforts? How to get a ideal result and how to find the most reliable resources? Here on Vcedump.com, you will find all the answers. Vcedump.com provide not only Oracle exam questions, answers and explanations but also complete assistance on your exam preparation and certification application. If you are confused on your 1Z0-1056-23 exam preparations and Oracle certification application, do not hesitate to visit our Vcedump.com to find your solutions here.