Exam Details

Exam Code

:IIA-CFSAExam Name

:Certified Financial Services AuditorCertification

:IIA CertificationsVendor

:IIATotal Questions

:511 Q&AsLast Updated

:Apr 12, 2025

IIA IIA Certifications IIA-CFSA Questions & Answers

-

Question 251:

To limit strategic risk management should ensure proper balance between the:

A. Mortgage company's willingness to accept risk and its supporting resources and control

B. Internal operations and possibility of litigation

C. Managerial capacities and capabilities and delivery networks

D. All of these

-

Question 252:

Strategic Risk if not properly controlled, understood or measured may result in:

A. High Earnings volatility

B. Significant capital pressures

C. Withdrawal of loan portfolios by the customers

D. Only AandB

-

Question 253:

Compliance risk can lead t[o all of the following situations EXCEPT:

A. Diminished reputation

B. Reduced franchise value

C. limited business opportunities

D. None of these

-

Question 254:

Selectively increasing the price of a mortgages loan above the bank's established rate to certain customers ("overages") may have the effect of discriminating against those customers .This practice left undetected and not properly controlled may raise the possibility of:

A. Reputation risk

B. Price risk

C. litigation or regulatory action (compliance Risk)

D. Strategic Risk

-

Question 255:

In a price risk situation if customers withdraw their applications a bank may be unable to originate enough loans to meet its forward sales commitments .Because of this kind of "Fallout" a bank may have to purchase additional loans in the secondary market at prices higher than anticipated. Alternatively, a bank may choose to liquidate its commitment to sell and deliver mortgages by paying a fee to the counterparty commonly called a ______________.

A. Settlement

B. Pair-off arrangement

C. End of loan settlement

D. None of these

-

Question 256:

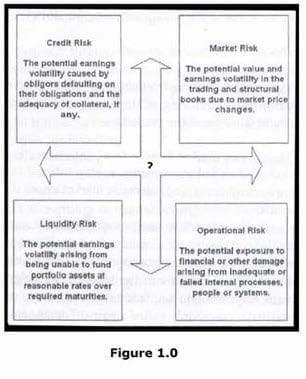

Which of the following best suits in place of question mark?

A. Risk spectrum

B. Risk platform

C. Risk levels

D. All of these

-

Question 257:

Interest rate risk arises from differences between the timing of rate changes and the timing of cash flows ( _________ );from changing rate relationships among different yield curves affecting bank activities ( ____________ ); from changing rate relationship across the spectrum of maturities ( ____________ );and from internet-related options embedded in bank products ( _____________ ). Choose the appropriate set.

A. Repricing risk, basic risk, yield curve risk and option risk

B. Basic risk, yield curve risk, option risk and Repricing risk

C. Repricing risk option risk, yield curve risk, and basic risk

D. Basic risk, yield curve risk, option risk and repurchasing risk

-

Question 258:

Default risk is an alternate term used for:

A. Liquidity Risk

B. Credit Risk

C. Control Activities Risk

D. Operational Risk

-

Question 259:

Which one of the following is common misinterpretation during the calculation of VaR

A. The VaR calculation is based on an assumption that the portfolio is held constant over thetime interval in practice are actively managed so that as adverse condition develop actions will be taken to mitigate losses As a result the true probability of a lose as large as that predicted may be much less then Fore cast

B. The VaR Forecast is based on what has happened in the past If the future is not like the past the realized losses may be the lager (or smaller then predicted)

C. There is a tendency to interpret VaR as the largest loss that has on X percent probability of being exceeded. The largest that loss that may occur will not be too much larger than the aR, while for other portfolios (particularly those including highly levered derivatives), it may be many times greater than the VaR.

D. All of the above.

-

Question 260:

Known limitations of VaR methodology include the fact that changes in market may not tend to normal distribution (specifically, that very large movements are more likely than predicated by the normal distribution assumption); BECAUSE:

A. Correlation between market movement can vary (especially during periods of stress in themarket)

B. The changes in present values are not perfectly linearly related to changes market rates.

C. The use of one day horizon does not fully capture the market risk of positions that cannot be liquidated in one day.

D. All of these

Related Exams:

IIA-ACCA

ACCA CIA ChallengeIIA-CCSA

Certification in Control Self-AssessmentIIA-CFSA

Certified Financial Services AuditorIIA-CGAP

Certified Government Auditing ProfessionalIIA-CHAL-QISA

Qualified Info Systems Auditor CIA ChallengeIIA-CIA-PART1

Certified Internal Auditor - Part 1, The Internal Audit Activity's Role in Governance, Risk, and ControlIIA-CIA-PART2

Certified Internal Auditor - Part 2, Conducting the Internal Audit EngagementIIA-CIA-PART3

Certified Internal Auditor - Part 3 study guide with online reviewIIA-CIA-PART4

Certified Internal Auditor - Part 4, Business Management SkillsIIA-CRMA-ADV

Certification in Risk Management Assurance

Tips on How to Prepare for the Exams

Nowadays, the certification exams become more and more important and required by more and more enterprises when applying for a job. But how to prepare for the exam effectively? How to prepare for the exam in a short time with less efforts? How to get a ideal result and how to find the most reliable resources? Here on Vcedump.com, you will find all the answers. Vcedump.com provide not only IIA exam questions, answers and explanations but also complete assistance on your exam preparation and certification application. If you are confused on your IIA-CFSA exam preparations and IIA certification application, do not hesitate to visit our Vcedump.com to find your solutions here.