Exam Details

Exam Code

:IIA-CIA-PART1Exam Name

:Certified Internal Auditor - Part 1, The Internal Audit Activity's Role in Governance, Risk, and ControlCertification

:IIA CertificationsVendor

:IIATotal Questions

:566 Q&AsLast Updated

:Apr 13, 2025

IIA IIA Certifications IIA-CIA-PART1 Questions & Answers

-

Question 321:

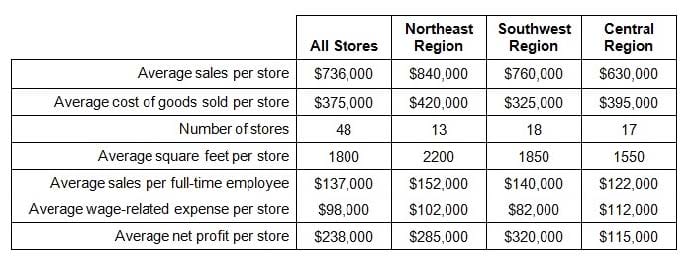

In preparing for an audit of the footwear division of a major retail organization, an internal auditor gathered the following information about the organization's stores:

In addition to labor costs, the other costs associated with each store are leasing and maintenance expenses. Which of the following is a valid conclusion?

A. Sales per store are directly related to the size of the store.

B. Employees are less productive in larger stores.

C. Gross margin is directly related to the size of the store.

D. Cost of goods sold is directly related to the size of the store.

-

Question 322:

An organization's sales professionals are potentially abusing the use of cellular phones, resulting in an alarming increase in telephone expenses. Which of the following controls is least likely to curb this abuse?

A. Developing periodic reports to management that show type, length, and number of calls per sales professional, with related totals and comparisons.

B. Requiring sales professionals to pay monthly cellular phone bills and subsequently submit only business calls for reimbursement using an expense report process.

C. Requiring sales managers to approve monthly bills prior to payment, explain budget variances, and explain increases from previous periods.

D. Requiring authorization of the cellular phone bill payment by the manager of the telecommunications department.

-

Question 323:

Which of the following topics would a chief audit executive most likely include with their report to the board?

A. The status of labor contract negotiations at the largest manufacturing plant.

B. A significant level of senior management turnover throughout the organization.

C. A recent management hire to oversee labor concerns.

D. Analyses of recent increases in overtime.

-

Question 324:

An external quality assurance review which was authorized by the chief audit executive (CAE) indicated significant findings from the Standards. To whom should the final results of the quality assurance review be reported?

A. Confidentially to the CAE only

B. The CAE with copies to the board and senior management.

C. To the board with copies to the external auditor or regulatory oversight body.

D. To the senior management with a copy to the board.

-

Question 325:

Which of the following should an internal auditor possess in order to fulfill the responsibilities of the internal audit activity?

A. Proficiency in applying management principles in order to stand in for the chief financial officer.

B. An understanding of management principles in order to evaluate deviations from good practices.

C. An appreciation of internal audit standards in order to recognize problems.

D. Proficiency in accounting principles in order to conduct fraud investigations.

-

Question 326:

Which of the following statements best describes the competency requirement for an auditor regarding fraud risks encountered in an engagement execution?

A. The auditor should be able to have comparable competencies of a person whose primary responsibility is detecting and investigating fraud.

B. The auditor must have sufficient knowledge to evaluate the risk of fraud and the manner in which it is managed by the organization.

C. The auditor is not expected to have any competency requirement regarding fraud since the role of investigating and detecting fraud belongs to other functions in the organization.

D. The auditor must be able to have an appreciation of the fundamentals of fraud detection and investigation techniques.

-

Question 327:

Which of the following factors is not likely to affect the level of inherent risk associated with an application system?

A. The system is strategic.

B. Controls over the system appear reliable.

C. The system is not a critical operating system.

D. The system uses complex technology.

-

Question 328:

Which of the following statements is not true?

A. The nature of consulting services that are performed by the internal audit activity should be defined in the audit charter.

B. It is inappropriate for internal auditors to provide consulting services relating to operations for which they had previous responsibilities.

C. A party outside the internal audit activity should oversee assurance engagements for functions over which the chief audit executive has responsibility.

D. The chief audit executive should decline a consulting engagement if the internal audit staff lacks the knowledge, skills, or other competencies needed to perform all or a part of the engagement.

-

Question 329:

Some of an organization's payroll transactions were batch posted to the payroll file but were not uploaded correctly to the general ledger file on the mainframe. The best control to detect this type of error would be:

A. Edit controls on the payroll file.

B. Appropriate segregation of duties for batch approval.

C. Validation of hash totals.

D. Reconciliation of paychecks to the bank account.

-

Question 330:

Which of the following is the primary advantage of using a computer assisted audit technique (CAAT) to provide a higher level of assurance?

A. CAATs can select an appropriate sample size for testing and thus provide higher level of assurance.

B. CAATs are more objective than the traditional methods in interpreting the results.

C. CAATs can examine the whole of population of transactions, rather than a sample, in order to identify exceptions and trends.

D. CAATs can process the results faster and thus give a higher level of assurance.

Related Exams:

IIA-ACCA

ACCA CIA ChallengeIIA-CCSA

Certification in Control Self-AssessmentIIA-CFSA

Certified Financial Services AuditorIIA-CGAP

Certified Government Auditing ProfessionalIIA-CHAL-QISA

Qualified Info Systems Auditor CIA ChallengeIIA-CIA-PART1

Certified Internal Auditor - Part 1, The Internal Audit Activity's Role in Governance, Risk, and ControlIIA-CIA-PART2

Certified Internal Auditor - Part 2, Conducting the Internal Audit EngagementIIA-CIA-PART3

Certified Internal Auditor - Part 3 study guide with online reviewIIA-CIA-PART4

Certified Internal Auditor - Part 4, Business Management SkillsIIA-CRMA-ADV

Certification in Risk Management Assurance

Tips on How to Prepare for the Exams

Nowadays, the certification exams become more and more important and required by more and more enterprises when applying for a job. But how to prepare for the exam effectively? How to prepare for the exam in a short time with less efforts? How to get a ideal result and how to find the most reliable resources? Here on Vcedump.com, you will find all the answers. Vcedump.com provide not only IIA exam questions, answers and explanations but also complete assistance on your exam preparation and certification application. If you are confused on your IIA-CIA-PART1 exam preparations and IIA certification application, do not hesitate to visit our Vcedump.com to find your solutions here.