Exam Details

Exam Code

:CAMS-FCIExam Name

:Advanced CAMS-Financial Crimes InvestigationsCertification

:ACAMS CertificationsVendor

:ACAMSTotal Questions

:101 Q&AsLast Updated

:Mar 06, 2025

ACAMS ACAMS Certifications CAMS-FCI Questions & Answers

-

Question 81:

A SAR/STR on cash activity is filed for a company registered in the Marshall Islands operating a Mediterranean beach bar and hotel. The company has three nominee directors, one nominee shareholder, and another individual declared as both the beneficial owner and authorized signatory. Which information is key for law enforcement's physical surveillance of cash activity? (Select Two.)

A. The identification details o' the nominee shareholder

B. The company's operating address

C. The identification details of the beneficial owner and authorized signatory

D. The company's registered address

E. The identification details the nominee directors

-

Question 82:

According to the Financial Action Task Force, as part of their risk assessment, which are important data and information that a Trust and Company Service Provider must understand when establishing and administering a trust? (Select Two.)

A. The responsibility and authority in the structure

B. The management structure of the trust

C. The source of funds in the structure

D. The general purpose behind the structure

E. The general nature of business of the trust

-

Question 83:

The compliance learn is reviewing multiple data points to include in its data analytics program to detect shell or front company red flags. Which data points should the compliance team include? (Select Two.)

A. Entities exhibiting transactions with declared counterparties

B. Entities whose principal place of business is a non-residential address

C. Entities with high paid-up capital relative to monthly value of transactions

D. Entities with a large number and variety of beneficiaries not declared at the time of onboarding

E. Entities transacting with or having relation to tax haven or high-risk countries

-

Question 84:

Which action is part of the enhanced due diligence process?

A. Collecting beneficial ownership details regarding the client's account

B. Using standard monitoring procedures to monitor transactions and account activity

C. Verifying the source of wealth for entities and natural person clients

D. Applying higher ownership percentage requirement for beneficial ownership collection

-

Question 85:

A financial institution (Fl) banks a money transmitter business (MTB) located in Miami. The MTB regularly initiates wire transfers with the ultimate beneficiary in Cuba and legally sells travel packages to Cuba. The wire transfers for money remittances comply with the country's economic sanctions policies. A Fl investigator on the sanctions team reviews each wire transfer to ensure compliance with sanctions and to monitor transfer details.

An airline located in Cuba, unrelated to the business, legally sells airline tickets in Cuba to Cuban citizens wanting to travel outside of Cuba. The airline tickets are purchased using Cuban currency (CUC).

The MTB wants 100,000 USD worth of CUC. Purchasing CUC from a Cuban bank includes a 4% fee. The MTB contacts the airline to ask if the airline will trade its CUC for USD at a lower exchange fee than the Cuban bank. The airline agrees to a 1% fee. The MTB initiates a wire transfer to the airline which appears as normal activity in the monitoring system because of the business' travel package sales.

The investigator recommends that a SAR/STR be filed. What documentation should be referenced in the SAR/STR filing? (Select Three.)

A. All documents related to the agreement between the airline and the MTB

B. Cumulative dollar amount of the wire transfer activity

C. Airline's ticket sales and passenger list

D. Cumulative dollar amount for transactions listing for all the MTB account's wire activity regarding travel packages

E. Licensing information regarding the travel agency providing tourist sales to Cuba

F. Account documentation on all related accounts maintained by the MTB

-

Question 86:

How does the Asian/Pacific Financial Action Task Force

-Style Regional Body help its members implement recommendations from the FATF? (Select Two.) A. Promotes laws that allow judicial challenges to seizure orders by an administrative body

B. Endorses regulations that define money laundering based on the model laws issued by the respective member states

C. Facilitates the adoption and implementation of internationally accepted AMI measures by member jurisdictions

D. Encourages cooperative AML efforts in the region

E. Requires members to maintain lists of regional money laundering and terrorists financing issues relevant to their region

-

Question 87:

Which are primary purposes of Financial Action Task Force {FATF)-Style Regional Bodies? (Select Two.)

A. Acting as a prudential regulatory body for financial institutions

B. Providing due diligence for foreign correspondent banks

C. Providing expertise and input in FATF policy-making

D. Imposing special measures for non-cooperative jurisdictions

E. Promoting effective implementation of FATF recommendations

-

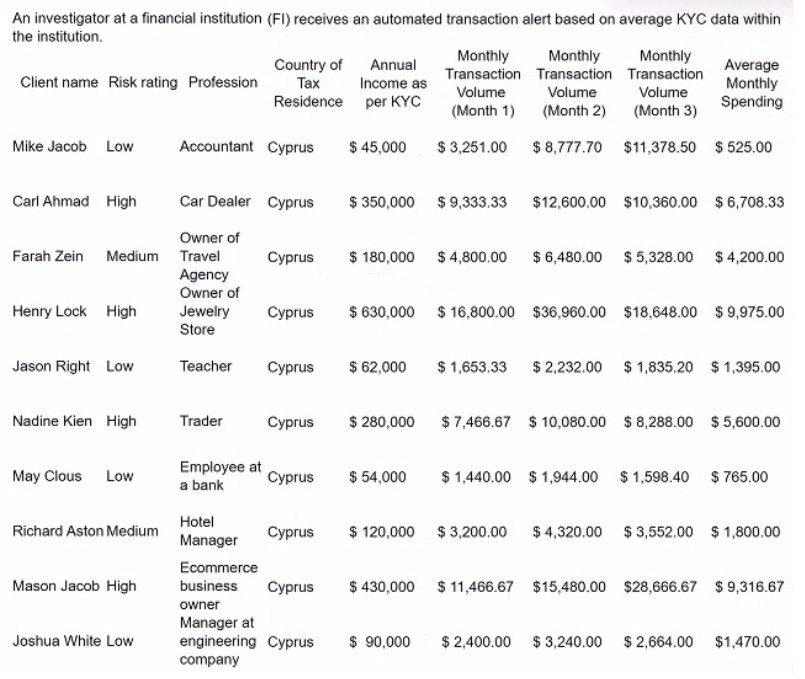

Question 88:

In a review of the account activity associated with Nadine Kien, an investigator observes a large number of small- to medium-size deposits from numerous individuals from several different global regions. The money is then transferred to a numbered company. Which is the next best course of action for the investigator?

A. Complete the monthly review and note the activity for next month's review.

B. File a SAR/STR on the account activity in relation to a potential funnel account.

C. Recommend the account for exit due to frequent global transactions.

D. No further action is required as the customer is already rated at high-risk and the monthly spending is within expectations.

-

Question 89:

An EU bank account received 1.8 million EUR from a Swiss bank. The EU bank determines the originator was indicted by U.S. law enforcement, arrested in Switzerland, and extradited for alleged insider trading. Which is the best reason the EU bank should file a SAR/STR?

A. The originator was indicted by U.S. law enforcement.

B. Insider trading is a predicate offense in the U.S. and Switzerland.

C. The events raise concerns that the payment represents proceeds from insider trading.

D. The Swiss bank filed a SAR/STR with the Money Laundering Reporting Office Switzerland.

-

Question 90:

During transaction monitoring. Bank A learns that one of their customers. Med Supplies 123. is attempting to make a payment via wire totaling 382,500 USD to PPE Business LLC located in Mexico to purchase a large order of personal

protective equipment. specifically surgical masks and face shields. Upon further verification. Bank A decides to escalate and refers the case to investigators.

Bank A notes that, days prior to the above transaction, the same customer went to a Bank A location to wire 1,215,280 USD to Breath Well LTD located in Singapore. Breath Well was acting as an intermediary to purchase both 3-ply surgical

masks and face shields from China. Bank A decided not to complete the transaction due to concerns with the involved supplier in China. Moreover, the customer is attempting to send a third wire in the amount of 350,000 USD for the

purchase of these items, this time using a different vendor in China. The investigator must determine next steps in the investigation and what actions, if any.

should be taken against relevant parties.

During the investigation, Bank A receives a USA PATRIOT Act Section 314(a) request related to Med Supplies 123. Which steps should the investigator take when fulfilling the request? (Select Three.)

A. Exit the relationship with the business since it appears that customer is under investigation.

B. Do not respond to Financial Crimes Enforcement Network (FinCEN) if the requested information is not present in the financial institution's system of records.

C. Review the account(s) activity and proactively file a SAR/STR using the 314(a) request as the basis for the filing.

D. Report to Financial Crimes Enforcement Network (FinCEN) that a match was found without revealing any other details.

E. Report back to the Financial Crimes Enforcement Network (FinCEN) within 15 days of receipt of the request via a secure internet website.

F. Search its records expeditiously to determine whether it maintains(ed) any accounts for the subject(s) listed in the request.

Tips on How to Prepare for the Exams

Nowadays, the certification exams become more and more important and required by more and more enterprises when applying for a job. But how to prepare for the exam effectively? How to prepare for the exam in a short time with less efforts? How to get a ideal result and how to find the most reliable resources? Here on Vcedump.com, you will find all the answers. Vcedump.com provide not only ACAMS exam questions, answers and explanations but also complete assistance on your exam preparation and certification application. If you are confused on your CAMS-FCI exam preparations and ACAMS certification application, do not hesitate to visit our Vcedump.com to find your solutions here.