Exam Details

Exam Code

:CGFMExam Name

:Certified Government Financial ManagerCertification

:Test Prep CertificationsVendor

:Test PrepTotal Questions

:203 Q&AsLast Updated

:Apr 09, 2025

Test Prep Test Prep Certifications CGFM Questions & Answers

-

Question 181:

Notes to the financial statements are:

A. additional disclosures presented immediately following the government-wide and fund financial statements.

B. RSI following the MDandA.

C. supplemental information provided to transmit financial statements.

D. optional disclosures of management analysis at the end of the financial statements.

-

Question 182:

The general ledger management function of a federal agency's financial system:

A. must be approved by the Bureau for Program and Policy Coordination.

B. is promulgated by FASAB.

C. must be in full compliance with the U.S. Standard General Ledger.

D. is defined by the CFO Act of 1990.

-

Question 183:

A payment to the capital projects fund is recorded in the general fund as:

A. an expense.

B. an operating subsidy.

C. an interfund loan.

D. a transfer out.

-

Question 184:

Fund-level financial statements are prepared to present:

A. both a short and long term perspective on governmental finances.

B. information on financing activities.

C. information that is more narrowly focused than mandated by government standards.

D. a detailed short term view of government services.

-

Question 185:

The CAFR includes all of the following EXCEPT the:

A. basic financial statements.

B. MDandA.

C. RSI.

D. PAR.

-

Question 186:

A county fire department receives property tax revenue on a 55% (December), 40% (April), 5% (June) basis. The uncollectible portion is .05%. If the department received $5.1 million in December, the annual property tax revenues will be:

A. $10,200,000.

B. $ 9,272,727.

C. $ 9,268,091.

D. $ 8,809,091.

-

Question 187:

Other factors being equal, when the cost of inventory has increased over several financial statement periods, an agency using LIFO will:

A. need to restate their financial statements after five years of cost increases.

B. show a higher value of ending inventory than a similar agency that uses FIFO.

C. need to increase the audit frequency.

D. reflect lower net income than an agency that uses the average cost inventory method.

-

Question 188:

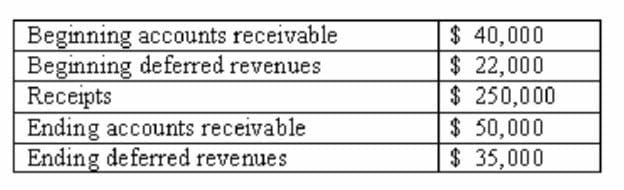

Based upon the information below, for a governmental fund calculate the amount of revenues for the year using the modified accrual basis of accounting, assuming all deferred revenues are related to receivables.

A. $278,000

B. $245,000

C. $247,000

D. $253,000

-

Question 189:

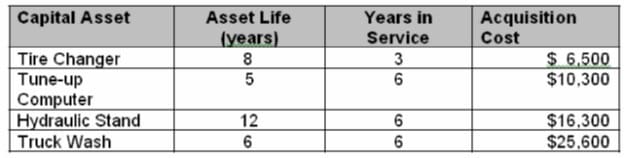

An ISF has the following capital equipment in service for the stated time. Based upon the information below, using the straight-line method, what should be charged for depreciation at year-end?

A. $8,155

B. $6,438

C. $4,267

D. $2,171

-

Question 190:

The modified accrual basis of accounting is characterized by:

A. revenues being recognized when realized.

B. revenues being recognized when measurable and available.

C. assets included in the general fixed asset account group.

D. expenditures recorded when warrants are paid.

Related Exams:

AACD

American Academy of Cosmetic DentistryACLS

Advanced Cardiac Life SupportASSET

ASSET Short Placement Tests Developed by ACTASSET-TEST

ASSET Short Placement Tests Developed by ACTBUSINESS-ENVIRONMENT-AND-CONCEPTS

Certified Public Accountant (Business Environment amd Concepts)CBEST-SECTION-1

California Basic Educational Skills Test - MathCBEST-SECTION-2

California Basic Educational Skills Test - ReadingCCE-CCC

Certified Cost Consultant / Cost Engineer (AACE International)CGFM

Certified Government Financial ManagerCGFNS

Commission on Graduates of Foreign Nursing Schools

Tips on How to Prepare for the Exams

Nowadays, the certification exams become more and more important and required by more and more enterprises when applying for a job. But how to prepare for the exam effectively? How to prepare for the exam in a short time with less efforts? How to get a ideal result and how to find the most reliable resources? Here on Vcedump.com, you will find all the answers. Vcedump.com provide not only Test Prep exam questions, answers and explanations but also complete assistance on your exam preparation and certification application. If you are confused on your CGFM exam preparations and Test Prep certification application, do not hesitate to visit our Vcedump.com to find your solutions here.