Exam Details

Exam Code

:FINANCIAL-ACCOUNTING-AND-REPORTINGExam Name

:Financial ReportingCertification

:Test Prep CertificationsVendor

:Test PrepTotal Questions

:163 Q&AsLast Updated

:Apr 14, 2025

Test Prep Test Prep Certifications FINANCIAL-ACCOUNTING-AND-REPORTING Questions & Answers

-

Question 151:

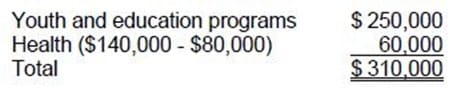

In Yew Co.'s 1992 annual report, Yew described its social awareness expenditures during the year as follows:

"The Company contributed $250,000 in cash to youth and educational programs. The Company also gave $140,000 to health and human-service organizations, of which $80,000 was contributed by employees through payroll deductions. In addition, consistent with the Company's commitment to the environment, the Company spent $100,000 to redesign product packaging." What amount of the above should be included in Yew's income statement as charitable contributions expense?

A. $310,000

B. $390,000

C. $410,000

D. $490,000

-

Question 152:

According to the FASB conceptual framework, which of the following relates to both relevance and reliability?

A. Comparability.

B. Feedback value.

C. Verifiability.

D. Timeliness.

-

Question 153:

Which of the following is true regarding the comparison of managerial to financial accounting?

A. Managerial accounting is generally more precise.

B. Managerial accounting has a past focus and financial accounting has a future focus.

C. The emphasis on managerial accounting is relevance and the emphasis on financial accounting is timeliness.

D. Managerial accounting need not follow generally accepted accounting principles (GAAP) while financial accounting must follow them.

-

Question 154:

According to the FASB conceptual framework, which of the following statements conforms to the realization concept?

A. Equipment depreciation was assigned to a production department and then to product unit costs.

B. Depreciated equipment was sold in exchange for a note receivable.

C. Cash was collected on accounts receivable.

D. Product unit costs were assigned to cost of goods sold when the units were sold.

-

Question 155:

What are the Statements of Financial Accounting Concepts intended to establish?

A. Generally accepted accounting principles in financial reporting by business enterprises.

B. The meaning of "Present fairly in accordance with generally accepted accounting principles."

C. The objectives and concepts for use in developing standards of financial accounting and reporting.

D. The hierarchy of sources of generally accepted accounting principles.

-

Question 156:

During a period when an enterprise is under the direction of a particular management, its financial statements will directly provide information about:

A. Both enterprise performance and management performance.

B. Management performance but not directly provide information about enterprise performance.

C. Enterprise performance but not directly provide information about management performance.

D. Neither enterprise performance nor management performance.

-

Question 157:

According to the FASB conceptual framework, the process of reporting an item in the financial statements of an entity is:

A. Allocation.

B. Matching.

C. Realization.

D. Recognition.

-

Question 158:

In the hierarchy of generally accepted accounting principles, APB Opinions have the same authority as AICPA:

A. Statements of Position.

B. Industry Audit and Accounting Guides.

C. Issues Papers.

D. Accounting Research Bulletins.

-

Question 159:

What is the underlying concept that supports the immediate recognition of a contingent loss?

A. Substance over form.

B. Consistency.

C. Matching.

D. Conservatism.

-

Question 160:

According to the FASB conceptual framework, the usefulness of providing information in financial statements is subject to the constraint of:

A. Consistency.

B. Cost-benefit.

C. Reliability.

D. Representational faithfulness.

Related Exams:

AACD

American Academy of Cosmetic DentistryACLS

Advanced Cardiac Life SupportASSET

ASSET Short Placement Tests Developed by ACTASSET-TEST

ASSET Short Placement Tests Developed by ACTBUSINESS-ENVIRONMENT-AND-CONCEPTS

Certified Public Accountant (Business Environment amd Concepts)CBEST-SECTION-1

California Basic Educational Skills Test - MathCBEST-SECTION-2

California Basic Educational Skills Test - ReadingCCE-CCC

Certified Cost Consultant / Cost Engineer (AACE International)CGFM

Certified Government Financial ManagerCGFNS

Commission on Graduates of Foreign Nursing Schools

Tips on How to Prepare for the Exams

Nowadays, the certification exams become more and more important and required by more and more enterprises when applying for a job. But how to prepare for the exam effectively? How to prepare for the exam in a short time with less efforts? How to get a ideal result and how to find the most reliable resources? Here on Vcedump.com, you will find all the answers. Vcedump.com provide not only Test Prep exam questions, answers and explanations but also complete assistance on your exam preparation and certification application. If you are confused on your FINANCIAL-ACCOUNTING-AND-REPORTING exam preparations and Test Prep certification application, do not hesitate to visit our Vcedump.com to find your solutions here.