Exam Details

Exam Code

:MB-800Exam Name

:Microsoft Dynamics 365 Business Central Functional ConsultantCertification

:Microsoft CertificationsVendor

:MicrosoftTotal Questions

:256 Q&AsLast Updated

:Mar 28, 2025

Microsoft Microsoft Certifications MB-800 Questions & Answers

-

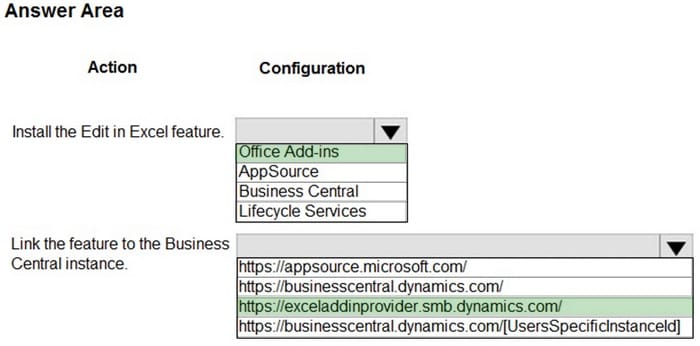

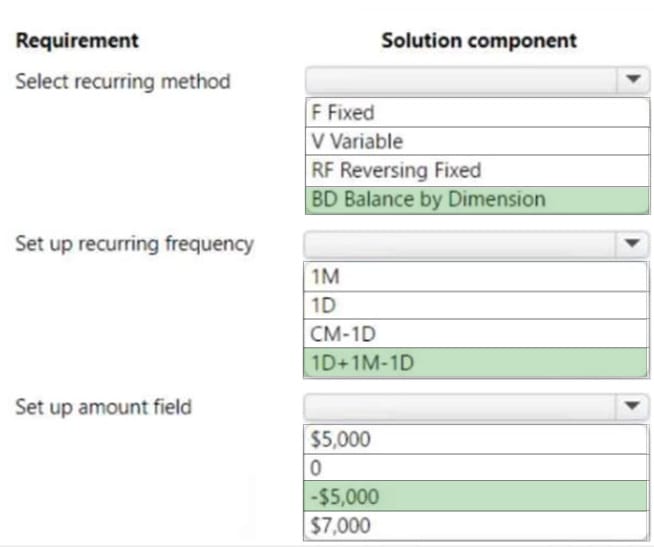

Question 151:

HOTSPOT

A company uses Dynamics 365 Business Central.

You need to ensure that the company can bulk edit data by using the Edit in Excel feature.

What should you use? To answer, select the appropriate options in the answer area.

NOTE: Each correct selection is worth one point.

Hot Area:

-

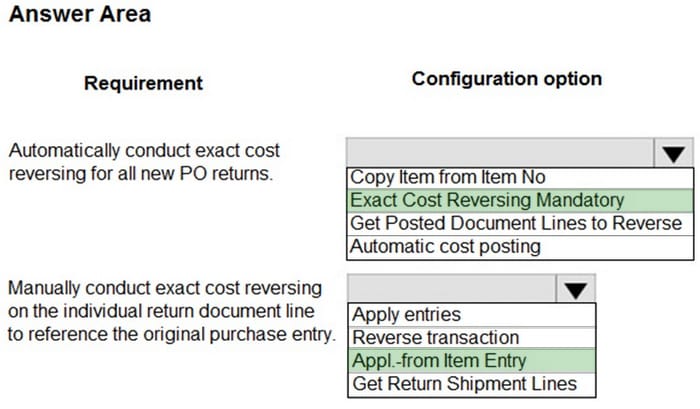

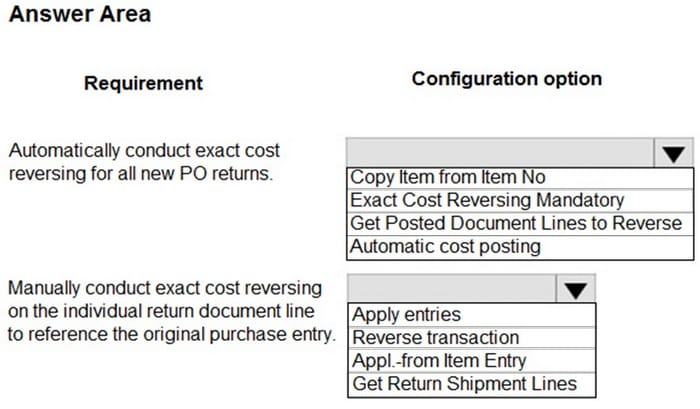

Question 152:

HOTSPOT

A company uses Dynamics 365 Business Central to manage accounts payables. The company uses exact cost reversing when returning products to vendors.

Returns use current costs at the time of the return. Exact cost reversing must be enforced manually for current orders and automatically applied to all future orders.

You need to configure the system.

Which configuration options should you use? To answer, select the appropriate options in the answer area.

NOTE: Each correct selection is worth one point. Hot Area:

-

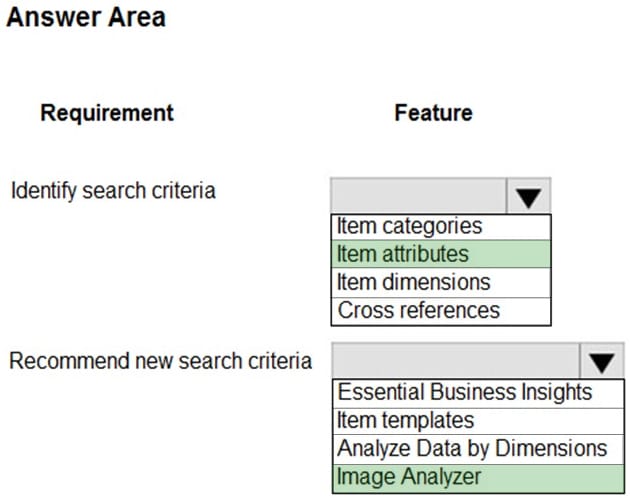

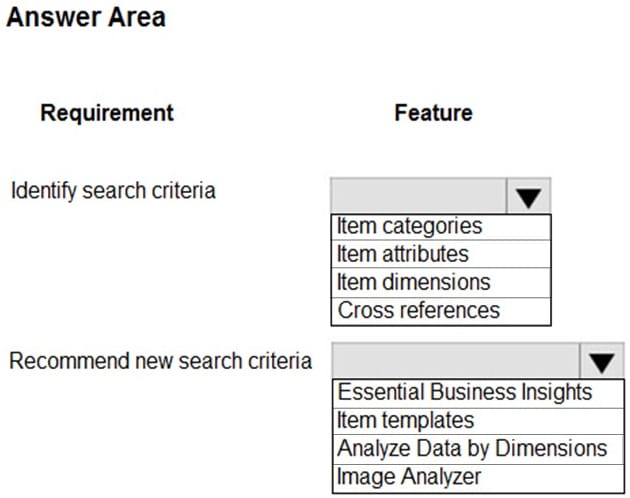

Question 153:

HOTSPOT

A furniture manufacturing company is creating new items in Dynamics 365 Business Central. The company currently searches for the products by material, color, and size.

You must expand the search capabilities for the items. Not all the items will have the same searchable characteristics. Some new search characteristics may need to be added.

You need to configure the system to automatically recommend additional search criteria for items.

Which features should you use? To answer, select the appropriate options in the answer area.

NOTE: Each correct selection is worth one point.

Hot Area:

-

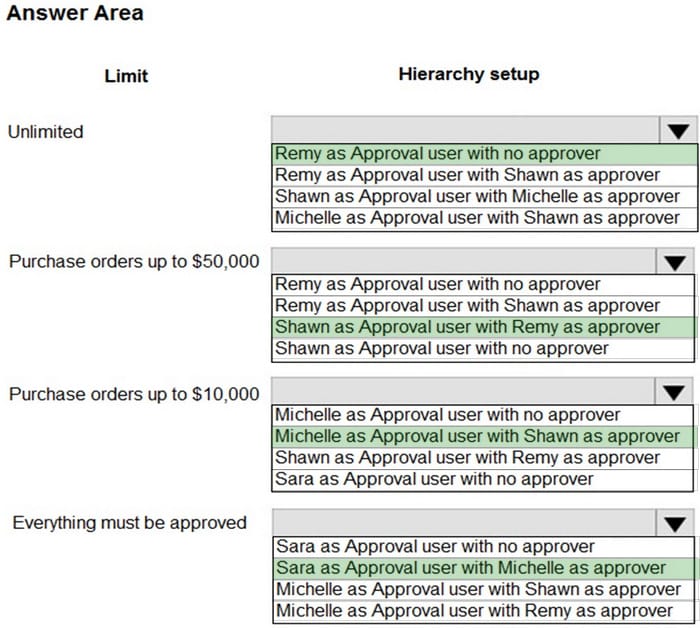

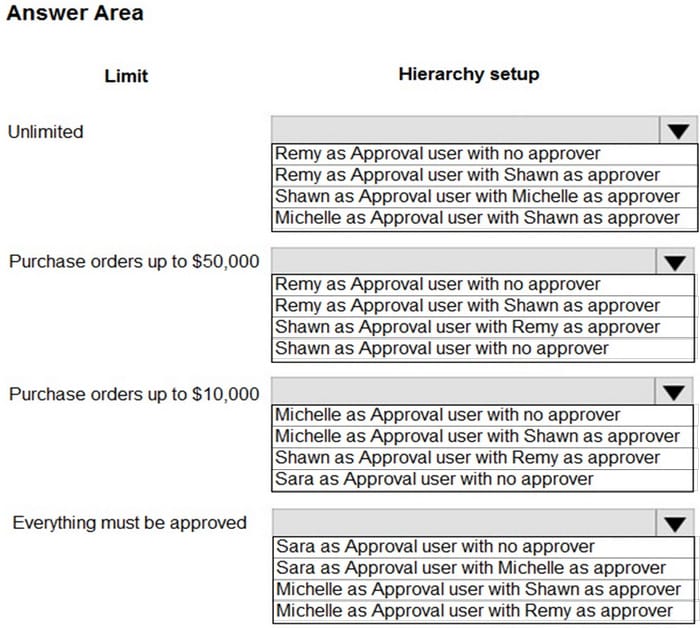

Question 154:

HOTSPOT

You are implementing Dynamics 365 Business Central.

The accounting manager wants to set up a complete Purchase Document Approval system with an approval hierarchy that meets the following requirements:

1.

Sara processes all purchase orders. Any purchase orders that Sara processes must be approved.

2.

Michelle can approve purchase orders up to $10,000.

3.

Shawn can approve the orders up to $50,000.

4.

Purchase orders above $50,000 must be approved by Remy.

You need to create the hierarchy.

Which hierarchy setup should be used for each limit? To answer, select the appropriate options in the answer area.

NOTE: Each correct selection is worth one point.

Hot Area:

-

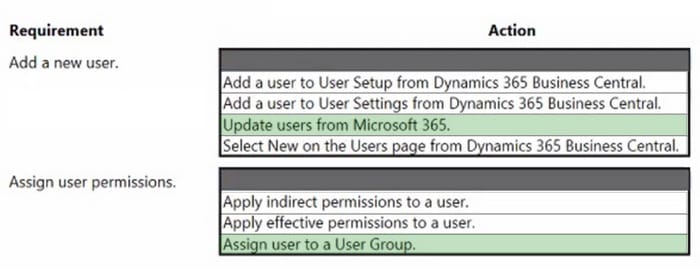

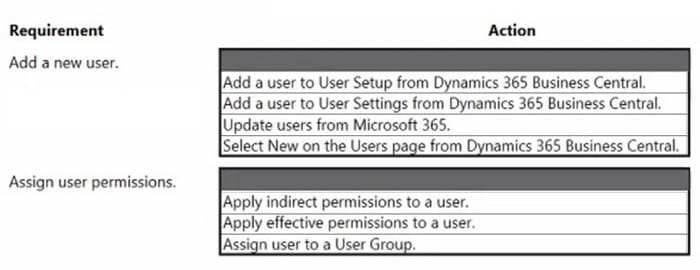

Question 155:

HOTSPOT

A company uses Dynamics 365 Business Central.

You need to create a user account for a new salesperson. The account must have the same permissions as other salespeople.

How should you configure the system? To answer, select the appropriate options in the answer area.

NOTE: Each correct selection is worth one point.

Hot Area:

-

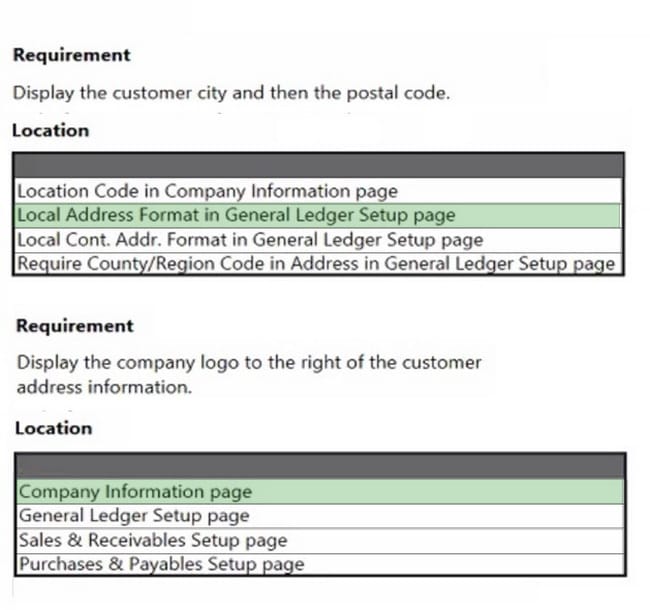

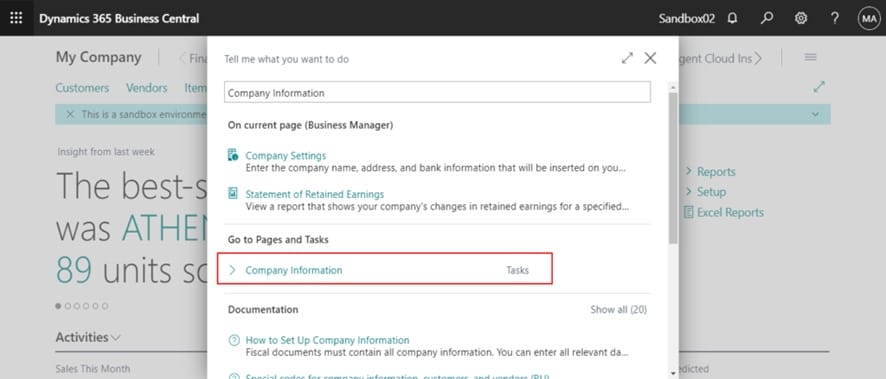

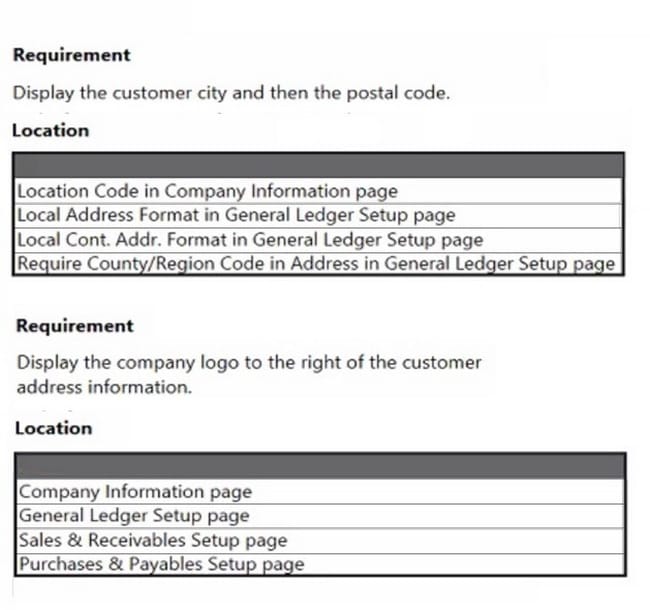

Question 156:

HOTSPOT

A company uses Dynamics 365 Business Central.

You need to customize sales invoice printouts to meet the following requirements:

1.

Display the customer city and then the postal code.

2.

Display the company logo to the right of the customer address information.

Where should you make the configuration change? To answer, select the appropriate options in the answer area.

NOTE: Each correct selection is worth one point.

Hot Area:

-

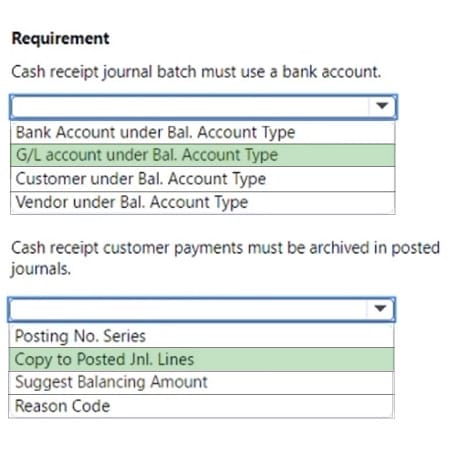

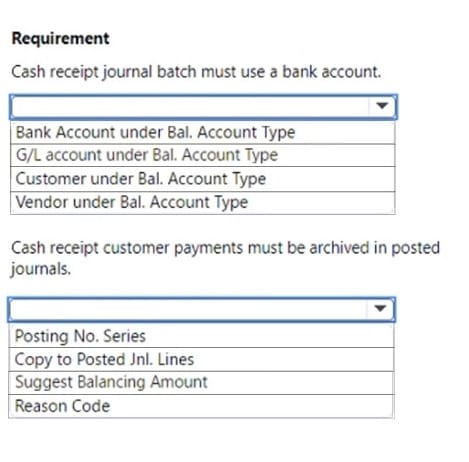

Question 157:

HOTSPOT

A company uses Dynamics 365 Business Central.

The company plans to implement a cash receipt journal batch based on the following requirements:

1.

The cash receipt journal batch must use a bank account by default.

2.

The cash receipt customer payments must be archived automatically in the posted journals.

The company uses the accrual basis for accounting.

You need to configure the cash receipt journal batch.

Which options should you use? To answer, select the appropriate options in the answer area.

NOTE: Each correct selection is worth one point.

Hot Area:

-

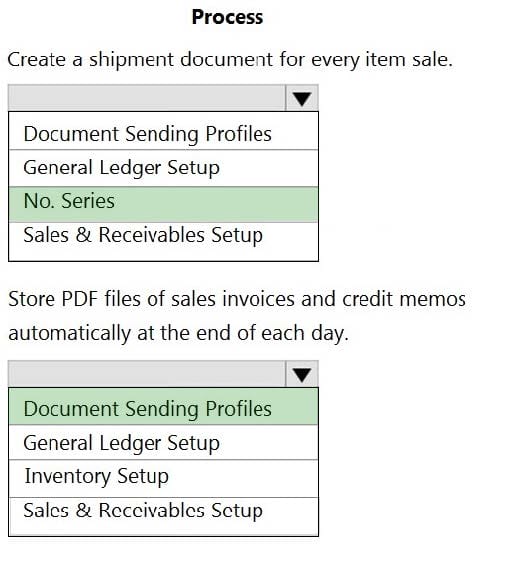

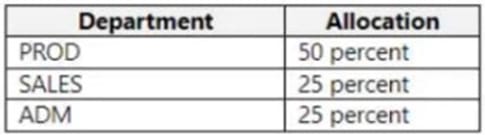

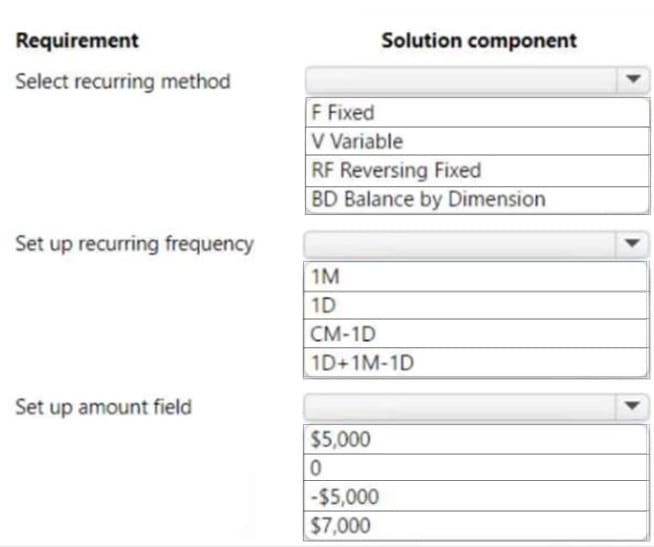

Question 158:

HOTSPOT A company uses Dynamics 365 Business Central. There are three departments (ADM, PROD and SALES) that are set up as dimensions. A customer wants to speed up the purchase invoice entry process for building materials by having the AP clerks fill purchase invoices without using dimensions. Monthly building expenses can vary between $5,000-$7,000 per month. The

allocation of building expenses is as follows:

Allocation of the monthly building expense between dimensions is required at the end of each month.

You need to configure the system to automatically allocate building expense total balances each month between dimensions.

How should you configure recurring general journals? To answer, select the appropriate options in the answer area.

NOTE: Each correct selection is worth one point.

Hot Area:

-

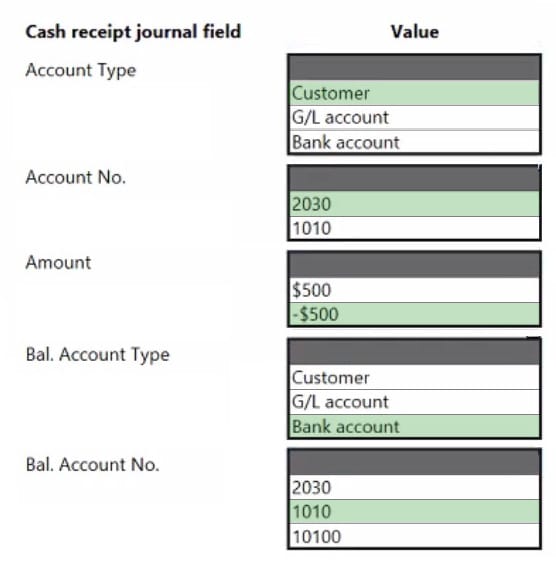

Question 159:

HOTSPOT

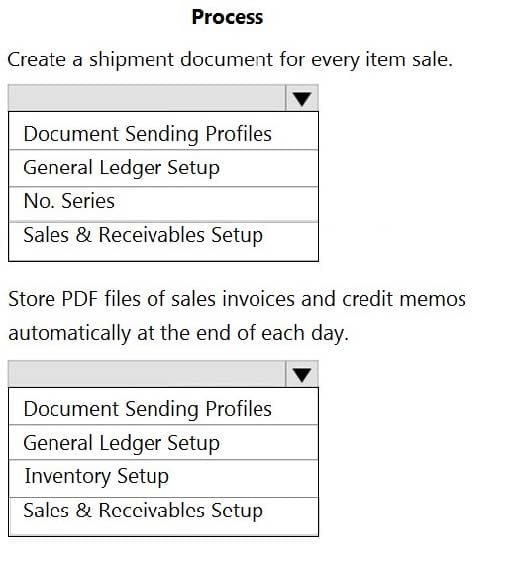

You complete the sales invoicing process for a company.

You need to validate the setup.

Which setup should you check for each process? To answer, select the appropriate options in the answer area.

NOTE: Each correct selection is worth one point.

Hot Area:

-

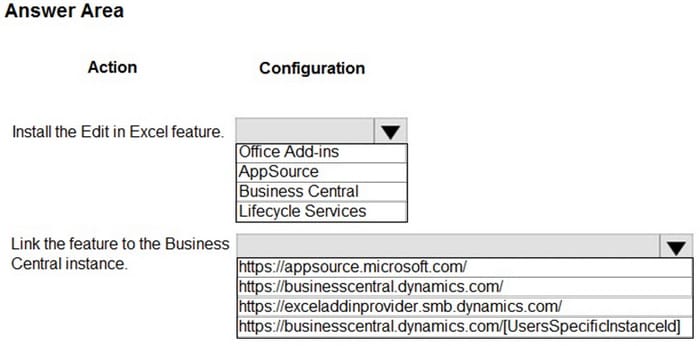

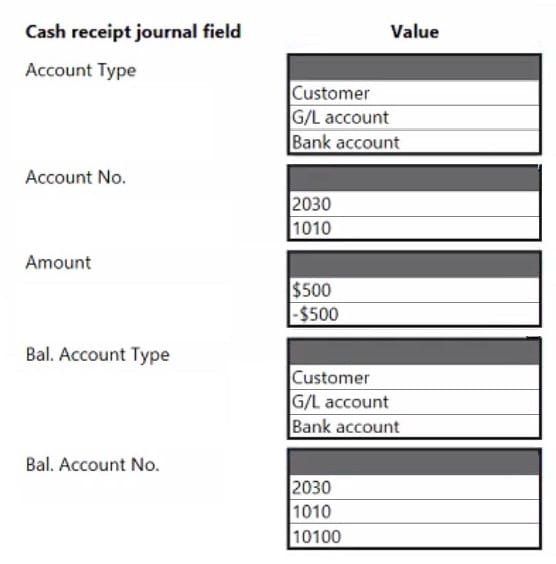

Question 160:

HOTSPOT

A company uses Dynamics 365 Business Central. You are recording incoming payments from customers.

You must record a payment of $500 for customer 2030 with a posting date of November 16, 2022. The payment must be recorded against bank account No. 1010 with general ledger (G/L) account No. 10100.

You need to populate the cash receipt journal batch in Business Central to properly record the incoming payment to a bank account.

Which value should you use? To answer, select the appropriate options in the answer area,

NOTE: Each correct selection is worth one point.

Hot Area:

Related Exams:

62-193

Technology Literacy for Educators70-243

Administering and Deploying System Center 2012 Configuration Manager70-355

Universal Windows Platform – App Data, Services, and Coding Patterns77-420

Excel 201377-427

Excel 2013 Expert Part One77-725

Word 2016 Core Document Creation, Collaboration and Communication77-726

Word 2016 Expert Creating Documents for Effective Communication77-727

Excel 2016 Core Data Analysis, Manipulation, and Presentation77-728

Excel 2016 Expert: Interpreting Data for Insights77-731

Outlook 2016 Core Communication, Collaboration and Email Skills

Tips on How to Prepare for the Exams

Nowadays, the certification exams become more and more important and required by more and more enterprises when applying for a job. But how to prepare for the exam effectively? How to prepare for the exam in a short time with less efforts? How to get a ideal result and how to find the most reliable resources? Here on Vcedump.com, you will find all the answers. Vcedump.com provide not only Microsoft exam questions, answers and explanations but also complete assistance on your exam preparation and certification application. If you are confused on your MB-800 exam preparations and Microsoft certification application, do not hesitate to visit our Vcedump.com to find your solutions here.