Exam Details

Exam Code

:BUSINESS-ENVIRONMENT-AND-CONCEPTSExam Name

:Certified Public Accountant (Business Environment amd Concepts)Certification

:Test Prep CertificationsVendor

:Test PrepTotal Questions

:530 Q&AsLast Updated

:Apr 11, 2025

Test Prep Test Prep Certifications BUSINESS-ENVIRONMENT-AND-CONCEPTS Questions & Answers

-

Question 121:

For capital budgeting purposes, management would select a high hurdle rate of return for certain projects because management:

A. Wants to use equity funding exclusively.

B. Believes bank loans are riskier than capital investments.

C. Believes capital investment proposals involve average risk.

D. Wants to factor risk into its consideration of projects.

-

Question 122:

All of the following are the rates used in net present value analysis, except for the:

A. Cost of capital.

B. Hurdle rate.

C. Discount rate.

D. Accounting rate of return.

-

Question 123:

When determining net present value in an inflationary environment, adjustments should be made to:

A. Increase the discount rate, only.

B. Increase the estimated cash inflows and increase the discount rate.

C. Increase the estimated cash inflows but not the discount rate.

D. Decrease the estimated cash inflows and increase the discount rate.

-

Question 124:

A company has unlimited capital funds to invest. The decision rule for the company to follow in order to maximize shareholders' wealth is to invest in all projects having a (n):

A. Present value greater than zero.

B. Net present value greater than zero.

C. Internal rate of return greater than zero.

D. Accounting rate of return greater than the hurdle rate used in capital budgeting analyses.

-

Question 125:

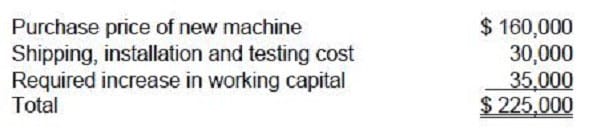

In order to increase production capacity, Gunning Industries is considering replacing an existing production machine with a new technologically improved machine effective January 1, 1997. The following information is being considered by Gunning Industries.

•

The new machine would be purchased for $160,000 in cash. Shipping, installation, and testing would cost

an additional $30,000.

•

The new machine is expected to increase annual sales by 20,000 units at a sales price of $40 per unit.

Incremental operating costs are comprised of $30 per unit in variable costs and total fixed costs of $40,000

per year.

•

The investment in the new machine will require an immediate increase in working capital of $35,000.

•

Gunning uses straight-line depreciation for financial reporting and tax reporting purposes. The new

machine has an estimated useful life of five years and zero salvage value.

•

Gunning is subject to a 40 percent corporate income tax rate.

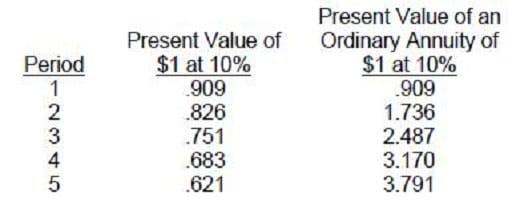

Gunning uses the net present value method to analyze investments and will employ the following factors

and rates.

Gunning Industries' net cash outflow in a capital budgeting decision would be:

A. $190,000

B. $195,000

C. $204,525

D. $225,000

-

Question 126:

The method that recognizes the time value of money by discounting the after-tax cash flows over the life of a project, using the company's minimum desired rate of return is the:

A. Accounting rate of return method.

B. Net present value method.

C. Internal rate of return method.

D. Payback method.

-

Question 127:

All of the following items are included in discounted cash flow analysis, except:

A. Future operating cash savings.

B. The current asset disposal price.

C. The future asset depreciation expense.

D. The tax effects of future asset depreciation.

-

Question 128:

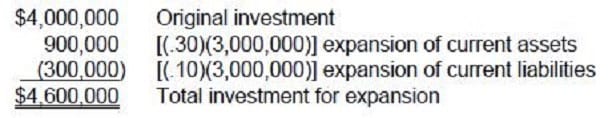

Lawson Inc. is expanding its manufacturing plant, which requires an investment of $4 million in new equipment and plant modifications. Lawson's sales are expected to increase by $3 million per year as a result of the expansion. Cash investment in current assets averages 30 percent of sales; accounts payable and other current liabilities are 10 percent of sales. What is the estimated total investment for this expansion?

A. $3.4 million.

B. $4.3 million.

C. $4.6 million.

D. $4.9 million.

-

Question 129:

Which one of the following is most relevant to a manufacturing equipment replacement decision?

A. Original cost of the old equipment.

B. Disposal price of the old equipment.

C. Gain or loss on the disposal of the old equipment.

D. A lump-sum write-off amount from the disposal of the old equipment.

-

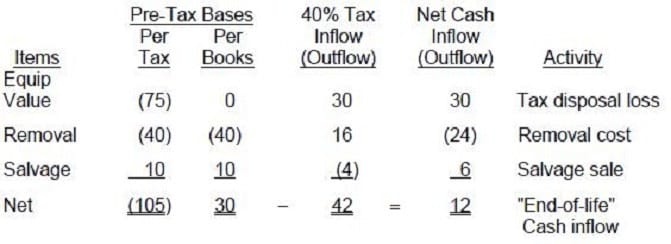

Question 130:

Kore Industries is analyzing a capital investment proposal for new equipment to produce a product over the next eight years. The analyst is attempting to determine the appropriate "end-of-life" cash flows for the analysis. At the end of eight years, the equipment must be removed from the plant and will have a net book value of zero, a tax basis of $75,000, a cost to remove of $40,000, and scrap salvage value of $10,000. Kore's effective tax rate is 40 percent. What is the appropriate "end-of-life" cash flow related to these items that should be used in the analysis?

A. $27,000

B. $12,000

C. $(18,000)

D. $(30,000)

Related Exams:

AACD

American Academy of Cosmetic DentistryACLS

Advanced Cardiac Life SupportASSET

ASSET Short Placement Tests Developed by ACTASSET-TEST

ASSET Short Placement Tests Developed by ACTBUSINESS-ENVIRONMENT-AND-CONCEPTS

Certified Public Accountant (Business Environment amd Concepts)CBEST-SECTION-1

California Basic Educational Skills Test - MathCBEST-SECTION-2

California Basic Educational Skills Test - ReadingCCE-CCC

Certified Cost Consultant / Cost Engineer (AACE International)CGFM

Certified Government Financial ManagerCGFNS

Commission on Graduates of Foreign Nursing Schools

Tips on How to Prepare for the Exams

Nowadays, the certification exams become more and more important and required by more and more enterprises when applying for a job. But how to prepare for the exam effectively? How to prepare for the exam in a short time with less efforts? How to get a ideal result and how to find the most reliable resources? Here on Vcedump.com, you will find all the answers. Vcedump.com provide not only Test Prep exam questions, answers and explanations but also complete assistance on your exam preparation and certification application. If you are confused on your BUSINESS-ENVIRONMENT-AND-CONCEPTS exam preparations and Test Prep certification application, do not hesitate to visit our Vcedump.com to find your solutions here.