Exam Details

Exam Code

:BUSINESS-ENVIRONMENT-AND-CONCEPTSExam Name

:Certified Public Accountant (Business Environment amd Concepts)Certification

:Test Prep CertificationsVendor

:Test PrepTotal Questions

:530 Q&AsLast Updated

:Apr 11, 2025

Test Prep Test Prep Certifications BUSINESS-ENVIRONMENT-AND-CONCEPTS Questions & Answers

-

Question 521:

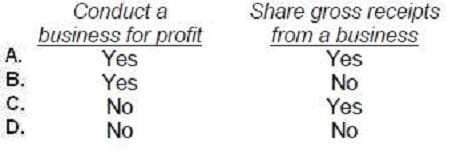

When parties intend to create a partnership that will be recognized under the Revised Uniform Partnership Act, they must agree to:

A. Option A

B. Option B

C. Option C

D. Option D

-

Question 522:

On February 1, Addison, Bradley, and Carter, physicians, formed ABC Medical Partnership. Dr. Bradley was placed in charge of the partnership's financial books and records. On April 1, Dr. Addison joined the City Hospital Medical Partnership, retaining the partnership interest in ABC. On May 1, ABC received a writ of attachment from the court attaching Dr. Carter's interest in ABC. The writ resulted from Dr. Carter's failure to pay a credit card bill. On June 1, Dr. Addison was adjudicated bankrupt. On July 1, Dr. Bradley was sued by the other partners of ABC for an accounting of ABC's revenues and expenses. Under the Revised Uniform Partnership Act, which of the preceding events resulted in the dissociation of a partner?

A. Dr. Addison joining the City Hospital Medical Partnership.

B. Dr. Carter's interest in the partnership being attached by the court.

C. Dr. Addison being adjudicated bankrupt.

D. Dr. Bradley being sued for an accounting by the other partners of ABC.

-

Question 523:

When a partner in a general partnership lacks actual or apparent authority to contract on behalf of the partnership, and the party contracted with is aware of this fact, the partnership will be bound by the contract if the other partners:

A. Option A

B. Option B

C. Option C

D. Option D

-

Question 524:

A general partnership must:

A. Pay federal income tax.

B. Have two or more partners.

C. Have written articles of partnership.

D. Provide for apportionment of liability for partnership debts.

-

Question 525:

What term is used to describe a partnership without a specified duration?

A. A perpetual partnership.

B. A partnership by estoppel.

C. An indefinite partnership.

D. A partnership at will.

-

Question 526:

Noll Corp. and Orr Corp. are contemplating entering into an unincorporated joint venture. Such a joint venture:

A. Will be treated as a partnership in most important legal respects.

B. Must be dissolved upon the completion of a single undertaking.

C. Will be treated as an association for federal income tax purposes and taxed at the prevailing corporate rates.

D. Must file a certificate of limited partnership with the appropriate state agency.

-

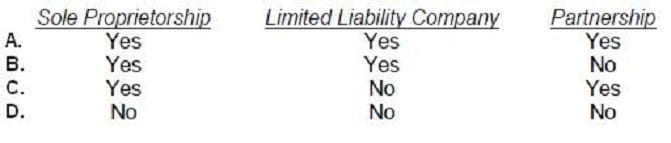

Question 527:

Which of the following forms of business can be formed with only one individual owning the business?

A. Option A

B. Option B

C. Option C

D. Option D

-

Question 528:

Formation of which of the following types of business does not require the filing of documents with the state?

A. Option A

B. Option B

C. Option C D. Option D

-

Question 529:

A sole proprietorship would be an ideal form of business to select if:

A. The individual desired no liability beyond his capital investment.

B. The individual wanted to be able sell the business at will.

C. The individual wanted the business to be a separate entity from the sole proprietor.

D. The individual wanted the business to continue indefinitely.

-

Question 530:

Fanny and John each own and manage their own companies. Fanny's business is manufacturing freight boxes of all types, and John's business is selling freight boxes to different industries. They decide to combine their expertise and knowledge to produce and sell freight boxes specifically designed for the new airline company that just formed in their city. Which of the following best describes the business formed by the parties?

A. A general partnership.

B. A limited liability partnership.

C. A sole proprietorship.

D. A joint venture.

Related Exams:

AACD

American Academy of Cosmetic DentistryACLS

Advanced Cardiac Life SupportASSET

ASSET Short Placement Tests Developed by ACTASSET-TEST

ASSET Short Placement Tests Developed by ACTBUSINESS-ENVIRONMENT-AND-CONCEPTS

Certified Public Accountant (Business Environment amd Concepts)CBEST-SECTION-1

California Basic Educational Skills Test - MathCBEST-SECTION-2

California Basic Educational Skills Test - ReadingCCE-CCC

Certified Cost Consultant / Cost Engineer (AACE International)CGFM

Certified Government Financial ManagerCGFNS

Commission on Graduates of Foreign Nursing Schools

Tips on How to Prepare for the Exams

Nowadays, the certification exams become more and more important and required by more and more enterprises when applying for a job. But how to prepare for the exam effectively? How to prepare for the exam in a short time with less efforts? How to get a ideal result and how to find the most reliable resources? Here on Vcedump.com, you will find all the answers. Vcedump.com provide not only Test Prep exam questions, answers and explanations but also complete assistance on your exam preparation and certification application. If you are confused on your BUSINESS-ENVIRONMENT-AND-CONCEPTS exam preparations and Test Prep certification application, do not hesitate to visit our Vcedump.com to find your solutions here.