Exam Details

Exam Code

:BUSINESS-ENVIRONMENT-AND-CONCEPTSExam Name

:Certified Public Accountant (Business Environment amd Concepts)Certification

:Test Prep CertificationsVendor

:Test PrepTotal Questions

:530 Q&AsLast Updated

:Apr 11, 2025

Test Prep Test Prep Certifications BUSINESS-ENVIRONMENT-AND-CONCEPTS Questions & Answers

-

Question 451:

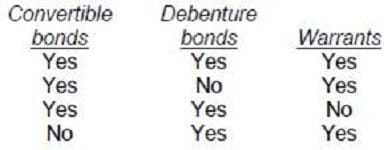

Which of the following securities are corporate debt securities?

A. Option A

B. Option B

C. Option C

D. Option D

-

Question 452:

Which of the following rights is a holder of a public corporation's cumulative preferred stock always entitled to?

A. Conversion of the preferred stock into common stock.

B. Voting rights.

C. Dividend carryovers from years in which dividends were not paid, to future years.

D. Guaranteed dividends.

-

Question 453:

Carr Corp. declared a 7% stock dividend on its common stock. The dividend:

A. Must be registered with the SEC pursuant to the Securities Act of 1933.

B. Is includable in the gross income of the recipient taxpayers in the year of receipt.

C. Has no effect on Carr's earnings and profits for federal income tax purposes.

D. Requires a vote of Carr's stockholders.

-

Question 454:

Absent a specific provision in its articles of incorporation, a corporation's board of directors has the unilateral power to do all of the following, except:

A. Repeal the bylaws.

B. Declare dividends.

C. Fix compensation of directors.

D. Amend the articles of incorporation.

-

Question 455:

Which of the following actions may a corporation take without its stockholders' consent?

A. Consolidate with one or more corporations.

B. Merge with one or more corporations.

C. Dissolve voluntarily.

D. Purchase 55% of another corporation's stock.

-

Question 456:

Generally, a corporation's articles of incorporation must include all of the following, except the:

A. Name of the corporation's registered agent.

B. Name of each incorporator.

C. Number of authorized shares.

D. Quorum requirements.

-

Question 457:

The corporate veil is most likely to be pierced and the shareholders held personally liable if:

A. The corporation has elected S corporation status under the Internal Revenue Code.

B. The shareholders have commingled their personal funds with those of the corporation.

C. An ultra vires act has been committed.

D. A partnership incorporates its business solely to limit the liability of its partners.

-

Question 458:

Which of the following provisions must a for-profit corporation include in its articles of incorporation to obtain a corporate charter?

I. Provision for the authorization of voting stock.

II.

Name of the corporation.

A.

I only.

B.

II only.

C.

Both I and II.

D.

Neither I nor II.

-

Question 459:

Under the Revised Model Business Corporation Act, a merger of two public corporations usually requires all of the following, except:

A. A formal plan of merger.

B. An affirmative vote by the holders of a majority of each corporation's voting shares.

C. Receipt of voting stock by all stockholders of the original corporations.

D. Approval by the board of directors of each corporation.

-

Question 460:

Under the Revised Model Business Corporation Act, which of the following must be contained in a corporation's articles of incorporation?

A. Quorum voting requirements.

B. Names of stockholders.

C. Provisions for issuance of par and nonpar shares.

D. The number of shares the corporation is authorized to issue.

Related Exams:

AACD

American Academy of Cosmetic DentistryACLS

Advanced Cardiac Life SupportASSET

ASSET Short Placement Tests Developed by ACTASSET-TEST

ASSET Short Placement Tests Developed by ACTBUSINESS-ENVIRONMENT-AND-CONCEPTS

Certified Public Accountant (Business Environment amd Concepts)CBEST-SECTION-1

California Basic Educational Skills Test - MathCBEST-SECTION-2

California Basic Educational Skills Test - ReadingCCE-CCC

Certified Cost Consultant / Cost Engineer (AACE International)CGFM

Certified Government Financial ManagerCGFNS

Commission on Graduates of Foreign Nursing Schools

Tips on How to Prepare for the Exams

Nowadays, the certification exams become more and more important and required by more and more enterprises when applying for a job. But how to prepare for the exam effectively? How to prepare for the exam in a short time with less efforts? How to get a ideal result and how to find the most reliable resources? Here on Vcedump.com, you will find all the answers. Vcedump.com provide not only Test Prep exam questions, answers and explanations but also complete assistance on your exam preparation and certification application. If you are confused on your BUSINESS-ENVIRONMENT-AND-CONCEPTS exam preparations and Test Prep certification application, do not hesitate to visit our Vcedump.com to find your solutions here.