Exam Details

Exam Code

:BUSINESS-ENVIRONMENT-AND-CONCEPTSExam Name

:Certified Public Accountant (Business Environment amd Concepts)Certification

:Test Prep CertificationsVendor

:Test PrepTotal Questions

:530 Q&AsLast Updated

:Apr 11, 2025

Test Prep Test Prep Certifications BUSINESS-ENVIRONMENT-AND-CONCEPTS Questions & Answers

-

Question 461:

Under the Revised Model Business Corporation Act, which of the following statements regarding a corporation's bylaws is(are) correct?

I. A corporation's initial bylaws shall be adopted by either the incorporators or the board of directors.

II.

A corporation's bylaws are contained in the articles of incorporation.

A.

I only.

B.

II only.

C.

Both I and II.

D.

Neither I nor II.

-

Question 462:

Acorn Corp. wants to acquire the entire business of Trend Corp. Which of the following methods of business combination will best satisfy Acorn's objectives without requiring the approval of the shareholders of either corporation?

A. A merger of Trend into Acorn, whereby Trend shareholders receive cash or Acorn shares.

B. A sale of all the assets of Trend, outside the regular course of business, to Acorn, for cash.

C. An acquisition of all the shares of Trend through a compulsory share exchange for Acorn shares.

D. A cash tender offer, whereby Acorn acquires at least 90% of Trend's shares, followed by a short-form merger of Trend into Acorn.

-

Question 463:

Which of the following statements is(are) correct regarding the methods a target corporation may use to ward off a takeover attempt?

I. The target corporation may make an offer ("self-tender") to acquire stock from its own shareholders.

II.

The target corporation may seek an injunction against the acquiring corporation on the grounds that the attempted takeover violates federal antitrust law.

A.

I only.

B.

II only.

C.

Both I and II.

D.

Neither I nor II.

-

Question 464:

Case Corp. is incorporated in State A. Under the Revised Model Business Corporation Act, which of the following activities engaged in by Case requires that Case obtain a certificate of authority to do business in State B?

A. Maintaining bank accounts in State B.

B. Collecting corporate debts in State B.

C. Hiring employees who are residents of state B.

D. Maintaining an office in State B to conduct intrastate business.

-

Question 465:

Which of the following parties generally has the most management rights?

A. Minority shareholder in a corporation listed on a national stock exchange.

B. Limited partner in a general partnership.

C. Member of a limited liability company.

D. Limited partner in a limited partnership.

-

Question 466:

Jeb, a member in J and S LLC, sold his interest in the LLC to Chris without obtaining the other members' consent. Absent an agreement to the contrary, Chris:

I. May participate in the management of J and S.

II. May receive Jeb's share of J and S's profits.

III.

Is not entitled to anything since Jeb did not obtain the other members' consent.

A.

I only.

B.

I and II only.

C.

II only.

D.

III only.

-

Question 467:

A member of a limited liability company may generally do all of the following, except:

A. Transfer his membership in the company without the consent of the other members.

B. Participate in the management of the company absent an agreement to the contrary.

C. Have limited liability.

D. Order office supplies for the company.

-

Question 468:

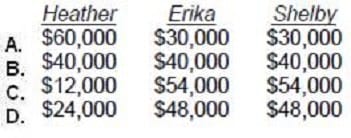

Heather, Erika, and Shelby are members in HES LLC. Heather works 40 hours per week and Erika and Shelby work 20 hours per week. Heather contributed $30,000 to the LLC and Erika and Shelby contributed $60,000 each. Erika and Shelby have each originated 45% of the LLC's business and Heather has originated the other 10%. Absent an agreement to the contrary, how will the LLC's $120,000 profits be divided among the members?

A. Option A

B. Option B

C. Option C

D. Option D

-

Question 469:

Heather, Erika, and Shelby are members in HES LLC. Heather dies. Absent an agreement to the contrary, what is the result?

A. The LLC must dissolve.

B. The LLC ceases to exist.

C. The LLC is dissolved unless the other members consent to continue.

D. The LLC continues as though nothing happened.

-

Question 470:

Heather, Erika, and Shelby are members in HES LLC. Heather works 40 hours per week and Erika and Shelby work 20 hours per week. Heather contributed $30,000 to the LLC and Erika and Shelby contributed $60,000 each. Erika and Shelby have each originated 45% of the LLC's business and Heather has originated the other 10%. Absent an agreement to the contrary among the owners, who controls the management of the HES LLC?

A. Heather, because she works the most.

B. Erika and Shelby equally because they contributed the most.

C. Heather, Erika, and Shelby in proportion to their ownership interests.

D. Erika and Shelby, because they originate most of the work.

Related Exams:

AACD

American Academy of Cosmetic DentistryACLS

Advanced Cardiac Life SupportASSET

ASSET Short Placement Tests Developed by ACTASSET-TEST

ASSET Short Placement Tests Developed by ACTBUSINESS-ENVIRONMENT-AND-CONCEPTS

Certified Public Accountant (Business Environment amd Concepts)CBEST-SECTION-1

California Basic Educational Skills Test - MathCBEST-SECTION-2

California Basic Educational Skills Test - ReadingCCE-CCC

Certified Cost Consultant / Cost Engineer (AACE International)CGFM

Certified Government Financial ManagerCGFNS

Commission on Graduates of Foreign Nursing Schools

Tips on How to Prepare for the Exams

Nowadays, the certification exams become more and more important and required by more and more enterprises when applying for a job. But how to prepare for the exam effectively? How to prepare for the exam in a short time with less efforts? How to get a ideal result and how to find the most reliable resources? Here on Vcedump.com, you will find all the answers. Vcedump.com provide not only Test Prep exam questions, answers and explanations but also complete assistance on your exam preparation and certification application. If you are confused on your BUSINESS-ENVIRONMENT-AND-CONCEPTS exam preparations and Test Prep certification application, do not hesitate to visit our Vcedump.com to find your solutions here.