Exam Details

Exam Code

:BUSINESS-ENVIRONMENT-AND-CONCEPTSExam Name

:Certified Public Accountant (Business Environment amd Concepts)Certification

:Test Prep CertificationsVendor

:Test PrepTotal Questions

:530 Q&AsLast Updated

:Apr 11, 2025

Test Prep Test Prep Certifications BUSINESS-ENVIRONMENT-AND-CONCEPTS Questions & Answers

-

Question 491:

A limited liability partnership must:

A. File registration documents with the state in which it is formed.

B. Hold all partners personally liable for all debts and liabilities of the partnership and partners.

C. Carry no less than one hundred thousand dollars of property insurance.

D. Not have partners with professional licenses.

-

Question 492:

Sam, CPA, is one of the partners in a limited liability partnership with other CPAs. Sam avoids personal liability for:

A. The wrongful acts of employees acting under his supervision.

B. His own negligent acts.

C. The malpractice of his partners regarding errors and omissions.

D. The negligent actions of his subordinates under his direct control.

-

Question 493:

Fil and Breed are 50% partners in FandB Cars, a used-car dealership. FandB maintains an average used-car inventory worth $150,000. On January 5, National Bank obtained a $30,000 judgement against Fil and Fil's child on a loan that Fil had cosigned and on which Fil's child had defaulted. National sued FandB to be allowed to attach $30,000 worth of cars as part of Fil's interest in FandB's inventory. Will National prevail in its suit?

A. No, because the judgement was not against the partnership.

B. No, because attachment of the cars would dissolve the partnership by operation of law.

C. Yes, because National had a valid judgement against Fil.

D. Yes, because Fil's interest in the partnership inventory is an asset owned by Fil.

-

Question 494:

Berry, Drake, and Flanigan are partners in a general partnership. The partners made capital contributions as follows: Berry, $150,000; Drake, $100,000; and Flanigan, $50,000. Drake made a loan of $50,000 to the partnership. The partnership agreement specifies that Flanigan will receive a 50% share of profits, and Drake and Berry each will receive a 25% share of profits. Under the Revised Uniform Partnership Act and in the absence of any partnership agreement to the contrary, which of the following statements is correct regarding the sharing of losses?

A. The partners will share equally in any partnership losses.

B. The partners will share in losses on a pro rata basis according to the capital contributions.

C. The partners will share in losses on a pro rata basis according to the capital contributions and loans made to the partnership.

D. The partners will share in losses according to the allocation of profits specified in the partnership agreement.

-

Question 495:

Under the Revised Uniform Partnership Act, which of the following have the right to inspect partnership books and records?

A. Employees.

B. Former partners.

C. Inactive partners.

D. Transferees of partners' interests.

-

Question 496:

Leslie, Kelly, and Blair wanted to form a business. Which of the following business entities does not require the filing of organization documents with the state?

A. Limited partnership.

B. Joint venture.

C. Limited liability company.

D. Subchapter S corporation.

-

Question 497:

Smith and James were partners in S and J Partnership. The partnership agreement stated that all profits

and losses were allocated 60 percent to Smith and 40 percent to James. The partners decided to

terminate and wind up the partnership.

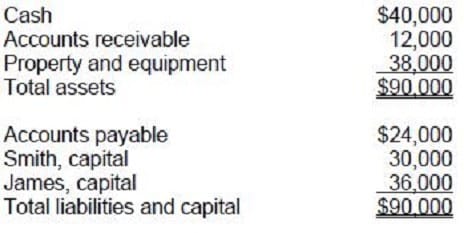

The following was the balance sheet for S and J on the day of the windup:

Of the total accounts receivable, $10,000 was collected and the remainder was written off as bad debt. All liabilities of S and J were paid by the partnership. The property and equipment are sold for $32,000. Under the Uniform Partnership Act, what amount of cash was distributed to Smith?

A. $25,200

B. $26,000

C. $30,000

D. $34,800

-

Question 498:

Under the Uniform Partnership Act, which of the following statements is(are) correct regarding the effect of the assignment of an interest in a general partnership?

I. The assignee is personally responsible for the assigning partner's share of past and future partnership debts.

II.

The assignee is entitled to the assigning partner's interest in partnership profits and surplus on dissolution of the partnership.

A.

I only.

B.

II only.

C.

Both I and II.

D.

Neither I nor II.

-

Question 499:

If no provisions are made in an agreement, a general partnership allocates profits and losses based on the:

A. Value of actual contributions made by each partner.

B. Number of partners.

C. Number of hours each partner worked in the partnership during the year.

D. Number of years each partner belonged to the partnership.

-

Question 500:

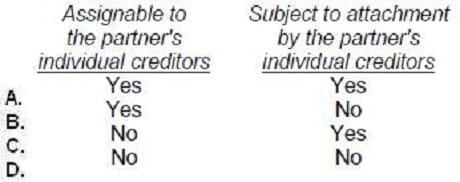

A partner's interest in specific partnership property is:

A. Option A

B. Option B

C. Option C

D. Option D

Related Exams:

AACD

American Academy of Cosmetic DentistryACLS

Advanced Cardiac Life SupportASSET

ASSET Short Placement Tests Developed by ACTASSET-TEST

ASSET Short Placement Tests Developed by ACTBUSINESS-ENVIRONMENT-AND-CONCEPTS

Certified Public Accountant (Business Environment amd Concepts)CBEST-SECTION-1

California Basic Educational Skills Test - MathCBEST-SECTION-2

California Basic Educational Skills Test - ReadingCCE-CCC

Certified Cost Consultant / Cost Engineer (AACE International)CGFM

Certified Government Financial ManagerCGFNS

Commission on Graduates of Foreign Nursing Schools

Tips on How to Prepare for the Exams

Nowadays, the certification exams become more and more important and required by more and more enterprises when applying for a job. But how to prepare for the exam effectively? How to prepare for the exam in a short time with less efforts? How to get a ideal result and how to find the most reliable resources? Here on Vcedump.com, you will find all the answers. Vcedump.com provide not only Test Prep exam questions, answers and explanations but also complete assistance on your exam preparation and certification application. If you are confused on your BUSINESS-ENVIRONMENT-AND-CONCEPTS exam preparations and Test Prep certification application, do not hesitate to visit our Vcedump.com to find your solutions here.