Exam Details

Exam Code

:BUSINESS-ENVIRONMENT-AND-CONCEPTSExam Name

:Certified Public Accountant (Business Environment amd Concepts)Certification

:Test Prep CertificationsVendor

:Test PrepTotal Questions

:530 Q&AsLast Updated

:Apr 11, 2025

Test Prep Test Prep Certifications BUSINESS-ENVIRONMENT-AND-CONCEPTS Questions & Answers

-

Question 501:

Cobb, Inc., a partner in TLC Partnership, assigns its partnership interest to Bean, who is not made a partner. After the assignment, Bean asserts the rights to:

I. Participate in the management of TLC.

II.

Cobb's share of TLC's partnership profits. Bean is correct as to which of these rights?

A.

I only.

B.

II only.

C.

I and II.

D. Neither I nor II.

-

Question 502:

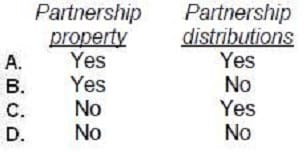

Unless the partnership agreement prohibits it, a partner in a general partnership may validly assign rights to:

A. Option A

B. Option B

C. Option C

D. Option D

-

Question 503:

Lark, a partner in DSJ, a general partnership, wishes to withdraw from the partnership and sell Lark's interest to Ward. All of the other partners in DSJ have agreed to admit Ward as a partner and to hold Lark harmless for the past, present, and future liabilities of DSJ. As a result of Lark's withdrawal and Ward's admission to the partnership, Ward:

A. Acquired only the right to receive Ward's share of DSJ profits.

B. Has the right to participate in DSJ's management.

C. Is personally liable for partnership liabilities arising before and after being admitted as a partner.

D. Must contribute cash or property to DSJ to be admitted with the same rights as the other partners.

-

Question 504:

Which of the following statements is correct concerning liability when a partner in a general partnership commits a tort while engaged in partnership business?

A. The partner committing the tort is the only party liable.

B. The partnership is the only party liable.

C. Each partner is jointly and severally liable.

D. Each partner is liable to pay an equal share of any judgment.

-

Question 505:

With respect to the following matters, which is correct if a general partnership agreement is silent?

A. A partnership will continue indefinitely unless a majority of the partners votes to dissolve the partnership.

B. Partnership losses are allocated in the same proportion as partnership profits.

C. A partner may assign his interest in the partnership but only with the consent of the other partners.

D. A partner may sell the goodwill of the partnership without the consent of the other partners when the sale is in the best interest of the partnership.

-

Question 506:

Gillie, Taft, and Dall are partners in an architectural firm. The partnership agreement is silent about the payment of salaries and the division of profits and losses. Gillie works full-time in the firm, and Taft and Dall each work half time. Taft invested $120,000 in the firm, and Gillie and Dall invested $60,000 each. Dall is responsible for bringing in 50% of the business, and Gillie and Taft 25% each. How should profits of $120,000 for the year be divided?

A. Gillie $60,000, Taft $30,000, Dall $30,000.

B. Gillie $40,000, Taft $40,000, Dall $40,000.

C. Gillie $30,000, Taft $60,000, Dall $30,000.

D. Gillie $30,000, Taft $30,000, Dall $60,000.

-

Question 507:

Lewis, Clark, and Beal entered into a written agreement to form a partnership. The agreement required that the partners make the following capital contributions: Lewis, $40,000, Clark, $30,000, and Beal, $10,000. It was also agreed that in the event the partnership experienced losses in excess of available capital, Beal would contribute additional capital to the extent of the losses. The partnership agreement was otherwise silent about division of profits and losses. Which of the following statements is correct?

A. Profits are to be divided among the partners in proportion to their relative capital contributions.

B. Profits are to be divided equally among the partners.

C. Losses will be allocated in a manner different from the allocation of profits because the partners contributed different amounts of capital.

D. Beal's obligation to contribute additional capital would have an effect on the allocation of profit or loss to Beal.

-

Question 508:

Downs, Frey, and Vick formed the DFV general partnership to act as manufacturers' representatives. The partners agreed Downs would receive 40% of any partnership profits and Frey and Vick would each receive 30% of such profits. It was also agreed that the partnership would not terminate for five years. After the fourth year, the partners agreed to terminate the partnership. At that time, the partners' capital accounts were as follows: Downs, $20,000; Frey, $15,000; and Vick, $10,000. There also were undistributed losses of $30,000. Vick's share of the undistributed losses will be:

A. $0

B. $1,000

C. $9,000

D. $10,000

-

Question 509:

Downs, Frey, and Vick formed the DFV general partnership to act as manufacturers' representatives. The partners agreed Downs would receive 40% of any partnership profits and Frey and Vick would each receive 30% of such profits. It was also agreed that the partnership would not terminate for five years. After the fourth year, the partners agreed to terminate the partnership. At that time, the partners' capital accounts were as follows: Downs, $20,000; Frey, $15,000; and Vick, $10,000. There also were undistributed losses of $30,000. Which of the following statements about the form of the DFV partnership agreement is correct?

A. It must be in writing because the partnership was to last for longer than one year.

B. It must be in writing because partnership profits would not be equally divided.

C. It could be oral because the partners had explicitly agreed to do business together.

D. It could be oral because the partnership did not deal in real estate.

-

Question 510:

Which of the following statements is correct regarding the division of profits in a general partnership when the written partnership agreement only provides that losses be divided equally among the partners?

Profits are to be divided:

A. Based on the partners' ratio of contribution to the partnership.

B. Based on the partners' participation in day-to-day management.

C. Equally among the partners.

D. Proportionately among the partners.

Related Exams:

AACD

American Academy of Cosmetic DentistryACLS

Advanced Cardiac Life SupportASSET

ASSET Short Placement Tests Developed by ACTASSET-TEST

ASSET Short Placement Tests Developed by ACTBUSINESS-ENVIRONMENT-AND-CONCEPTS

Certified Public Accountant (Business Environment amd Concepts)CBEST-SECTION-1

California Basic Educational Skills Test - MathCBEST-SECTION-2

California Basic Educational Skills Test - ReadingCCE-CCC

Certified Cost Consultant / Cost Engineer (AACE International)CGFM

Certified Government Financial ManagerCGFNS

Commission on Graduates of Foreign Nursing Schools

Tips on How to Prepare for the Exams

Nowadays, the certification exams become more and more important and required by more and more enterprises when applying for a job. But how to prepare for the exam effectively? How to prepare for the exam in a short time with less efforts? How to get a ideal result and how to find the most reliable resources? Here on Vcedump.com, you will find all the answers. Vcedump.com provide not only Test Prep exam questions, answers and explanations but also complete assistance on your exam preparation and certification application. If you are confused on your BUSINESS-ENVIRONMENT-AND-CONCEPTS exam preparations and Test Prep certification application, do not hesitate to visit our Vcedump.com to find your solutions here.