Exam Details

Exam Code

:FINANCIAL-ACCOUNTING-AND-REPORTINGExam Name

:Financial ReportingCertification

:Test Prep CertificationsVendor

:Test PrepTotal Questions

:163 Q&AsLast Updated

:Apr 14, 2025

Test Prep Test Prep Certifications FINANCIAL-ACCOUNTING-AND-REPORTING Questions & Answers

-

Question 101:

Due to a decline in market price in the second quarter, Petal Co. incurred an inventory loss. The market price is expected to return to previous levels by the end of the year. At the end of the year the decline had not reversed. When should the loss be reported in Petal's interim income statements?

A. Ratably over the second, third, and forth [sic] quarters.

B. Ratably over the third and fourth quarters.

C. In the second quarter only.

D. In the fourth quarter only.

-

Question 102:

In general, an enterprise preparing interim financial statements should:

A. Defer recognition of seasonal revenue.

B. Disregard permanent decreases in the market value of its inventory.

C. Allocate revenues and expenses evenly over the quarters, regardless of when they actually occurred.

D. Use the same accounting principles followed in preparing its latest annual financial statements.

-

Question 103:

During the first quarter of the calendar year, Worth Co. had income before taxes of $100,000, and its effective income tax rate was 15%. Worth's effective annual income tax rate for the previous year was 30% . Worth expects that its effective annual income tax rate for the current year will be 25%. The statutory tax rate for the current year is 35%. In its first quarter interim income statement, what amount of income tax expense should Worth report?

A. $15,000

B. $25,000

C. $30,000

D. $35,000

-

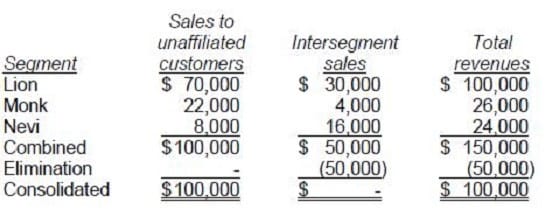

Question 104:

Terra Co.'s total revenues from its three operating segments were as follows: Which operating segment(s) is (are) deemed to be reportable segments?

A. None.

B. Lion only.

C. Lion and Monk only.

D. Lion, Monk, and Nevi.

-

Question 105:

Conceptually, interim financial statements can be described as emphasizing:

A. Timeliness over reliability.

B. Reliability over relevance.

C. Relevance over comparability.

D. Comparability over neutrality.

-

Question 106:

Which of the following is correct concerning financial statement disclosure of accounting policies?

A. Disclosures should be limited to principles and methods peculiar to the industry in which the company operates.

B. Disclosure of accounting policies is an integral part of the financial statements.

C. The format and location of accounting policy disclosures are fixed by generally accepted accounting principles.

D. Disclosures should duplicate details disclosed elsewhere in the financial statements.

-

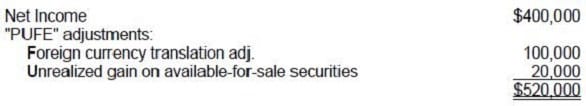

Question 107:

Rock Co.'s financial statements had the following balances at December 31:

What amount should Rock report as comprehensive income for the year ended December 31?

A. $400,000

B. $420,000

C. $520,000

D. $570,000

-

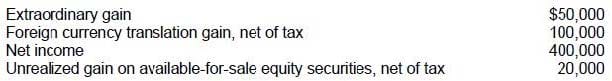

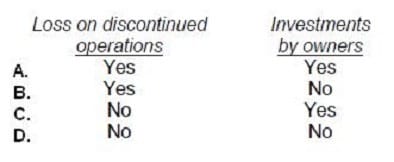

Question 108:

According to the FASB conceptual framework, comprehensive income includes which of the following?

A. Option A

B. Option B

C. Option C

D. Option D

-

Question 109:

Which of the following describes how comprehensive income should be reported?

A. Must be reported in a separate statement, as part of a complete set of financial statements.

B. Should not be reported in the financial statements but should only be disclosed in the footnotes.

C. May be reported in a separate statement, in a combined statement of income and comprehensive income, or within a statement of stockholders' equity.

D. May be reported in a combined statement of income and comprehensive income or disclosed within a statement of stockholders' equity; separate statements of comprehensive income are not permitted.

-

Question 110:

What is the purpose of information presented in notes to the financial statements?

A. To provide disclosures required by generally accepted accounting principles.

B. To correct improper presentation in the financial statements.

C. To provide recognition of amounts not included in the totals of the financial statements.

D. To present management's responses to auditor comments.

Related Exams:

AACD

American Academy of Cosmetic DentistryACLS

Advanced Cardiac Life SupportASSET

ASSET Short Placement Tests Developed by ACTASSET-TEST

ASSET Short Placement Tests Developed by ACTBUSINESS-ENVIRONMENT-AND-CONCEPTS

Certified Public Accountant (Business Environment amd Concepts)CBEST-SECTION-1

California Basic Educational Skills Test - MathCBEST-SECTION-2

California Basic Educational Skills Test - ReadingCCE-CCC

Certified Cost Consultant / Cost Engineer (AACE International)CGFM

Certified Government Financial ManagerCGFNS

Commission on Graduates of Foreign Nursing Schools

Tips on How to Prepare for the Exams

Nowadays, the certification exams become more and more important and required by more and more enterprises when applying for a job. But how to prepare for the exam effectively? How to prepare for the exam in a short time with less efforts? How to get a ideal result and how to find the most reliable resources? Here on Vcedump.com, you will find all the answers. Vcedump.com provide not only Test Prep exam questions, answers and explanations but also complete assistance on your exam preparation and certification application. If you are confused on your FINANCIAL-ACCOUNTING-AND-REPORTING exam preparations and Test Prep certification application, do not hesitate to visit our Vcedump.com to find your solutions here.