Exam Details

Exam Code

:BUSINESS-ENVIRONMENT-AND-CONCEPTSExam Name

:Certified Public Accountant (Business Environment amd Concepts)Certification

:Test Prep CertificationsVendor

:Test PrepTotal Questions

:530 Q&AsLast Updated

:Apr 11, 2025

Test Prep Test Prep Certifications BUSINESS-ENVIRONMENT-AND-CONCEPTS Questions & Answers

-

Question 101:

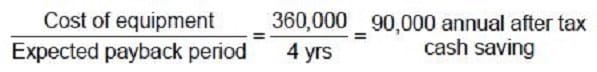

Whatney Co. is considering the acquisition of a new, more efficient press. The cost of the press is $360,000, and the press has an estimated six-year life with zero salvage value. Whatney uses straightline depreciation for both financial reporting and income tax reporting purposes and has a 40 percent corporate income tax rate. In evaluating equipment acquisitions of this type, Whatney uses a goal of a four-year payback period. To meet Whatney's desired payback period, the press must produce a minimum annual before-tax, operating cash savings of:

A. $90,000

B. $110,000

C. $114,000

D. $150,000

-

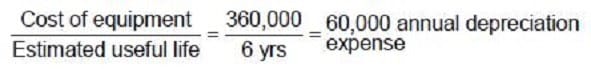

Question 102:

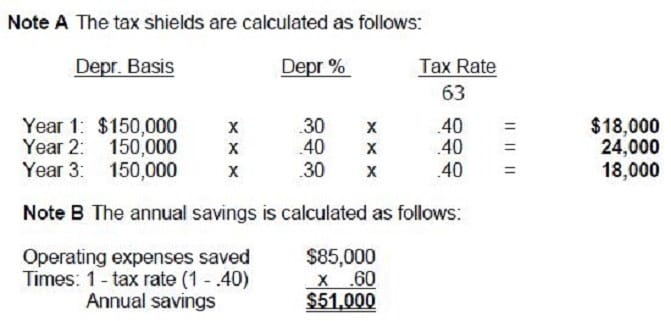

Willis, Inc. has a cost of capital of 15 percent and is considering the acquisition of a new machine, which costs $400,000 and has a useful life of five years. Willis projects that earnings and cash flow will increase as follows.

What is the payback period of this investment?

A. 1.50 years

B. 3.00 years

C. 3.33 years

D. 4.00 years

-

Question 103:

Which one or the following statements about the payback method of investment analysis is correct? The payback method:

A. Does not consider the time value of money.

B. Uses discounted cash flow techniques.

C. Generally leads to the same decision as other methods for long-term projects.

D. Is rarely used in practice.

-

Question 104:

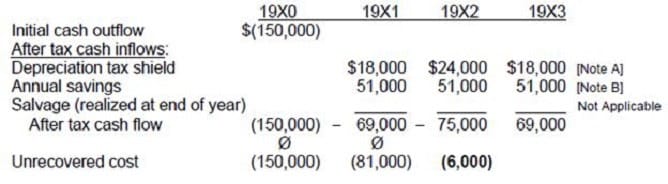

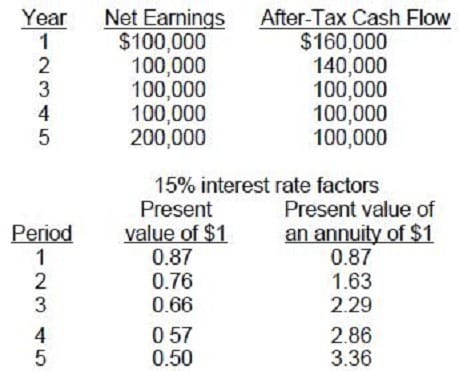

McLean Inc. is considering the purchase of a new machine that will cost $150,000. The machine has an estimated useful life of three years. Assume for simplicity that the equipment will be fully depreciated 30, 40, and 30 percent in each of the three years, respectively. The new machine will have a $10,000 resale value at the end of its estimated useful life. The machine is expected to save the company $85,000 per year in operating expenses. McLean uses a 40 percent estimated income tax rate and a 16 percent hurdle rate to evaluate capital projects. Discount rates for a 16 percent rate are as follows:

The payback period for this investment would be:

A. 2.95 years

B. 1.76 years

C. 2.09 years

D. 2.94 years

-

Question 105:

A characteristic of the payback method (before taxes) is that it:

A. Incorporates the time value of money.

B. Neglects total project profitability.

C. Uses accrual accounting inflows in the numerator of the calculation.

D. Uses the estimated expected life of the asset in the denominator of the calculation.

-

Question 106:

The length of time required to recover the initial cash outlay of a capital project is determined by using the:

A. Discounted cash flow method.

B. Payback method.

C. Net present value method.

D. Accounting rate of return method.

-

Question 107:

The method that divides a project's annual after-tax net income by the average investment cost to measure the estimated performance of a capital investment is the:

A. Internal rate of return method.

B. Accounting rate of return method.

C. Payback method.

D. Net present value method.

-

Question 108:

The internal rate of return (IRR) is the:

A. Hurdle rate.

B. Rate of interest where the net present value is greater than 1.0.

C. Rate of interest where the net present value is equal to zero.

D. Rate of return generated from the operational cash flows.

-

Question 109:

The internal rate of return is the:

A. Rate of interest that equates the present value of cash outflows and the present value of cash inflows.

B. Risk-adjusted rate of return.

C. Required rate of return.

D. Weighted average rate of return generated by internal funds.

-

Question 110:

The internal rate of return for a project can be determined:

A. Only if the project cash flows are constant.

B. By finding the discount rate that yields a net present value of zero for the project.

C. By subtracting the firm's cost of capital from the project's profitability index.

D. Only if the project's profitability index is greater than one.

Related Exams:

AACD

American Academy of Cosmetic DentistryACLS

Advanced Cardiac Life SupportASSET

ASSET Short Placement Tests Developed by ACTASSET-TEST

ASSET Short Placement Tests Developed by ACTBUSINESS-ENVIRONMENT-AND-CONCEPTS

Certified Public Accountant (Business Environment amd Concepts)CBEST-SECTION-1

California Basic Educational Skills Test - MathCBEST-SECTION-2

California Basic Educational Skills Test - ReadingCCE-CCC

Certified Cost Consultant / Cost Engineer (AACE International)CGFM

Certified Government Financial ManagerCGFNS

Commission on Graduates of Foreign Nursing Schools

Tips on How to Prepare for the Exams

Nowadays, the certification exams become more and more important and required by more and more enterprises when applying for a job. But how to prepare for the exam effectively? How to prepare for the exam in a short time with less efforts? How to get a ideal result and how to find the most reliable resources? Here on Vcedump.com, you will find all the answers. Vcedump.com provide not only Test Prep exam questions, answers and explanations but also complete assistance on your exam preparation and certification application. If you are confused on your BUSINESS-ENVIRONMENT-AND-CONCEPTS exam preparations and Test Prep certification application, do not hesitate to visit our Vcedump.com to find your solutions here.