Exam Details

Exam Code

:BUSINESS-ENVIRONMENT-AND-CONCEPTSExam Name

:Certified Public Accountant (Business Environment amd Concepts)Certification

:Test Prep CertificationsVendor

:Test PrepTotal Questions

:530 Q&AsLast Updated

:Apr 11, 2025

Test Prep Test Prep Certifications BUSINESS-ENVIRONMENT-AND-CONCEPTS Questions & Answers

-

Question 191:

If Brewer Corporation's bonds are currently yielding 8 percent in the marketplace, why would the firm's cost of debt be lower?

A. Market interest rates have increased.

B. Additional debt can be issued more cheaply that the original debt.

C. Interest is deductible for tax purposes.

D. There is a mixture of old and new debt.

-

Question 192:

Investment managers develop portfolios of different investments to combine, offset, and thereby reduce overall risk. Not all risks can be eliminated by development of a portfolio. Risks that cannot be eliminated through a portfolio are called:

A. Non-market risks.

B. Unsystematic risks.

C. Firm-specific risks.

D. Systematic risks.

-

Question 193:

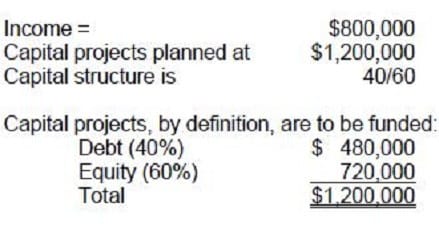

Residco, Inc. expects net income of $800,000 for the next fiscal year. Its targeted and current capital structure is 40 percent debt and 60 percent common equity. The director of capital budgeting has determined that the optimal capital spending for next year is $1.2 million. Residco does not plan to issue any new common equity next year. If Residco follows a strict residual dividend policy, what is the expected dividend payout ratio for next year?

A. 90.0 percent.

B. 66.7 percent.

C. 40.0 percent.

D. 10.0 percent.

-

Question 194:

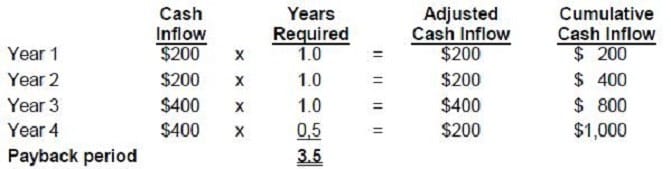

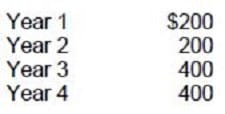

A project has an initial outlay of $1,000. The projected cash inflows are:

What is the investment's payback period?

A. 4.0 years.

B. 3.5 years.

C. 3.4 years.

D. 3.0 years.

-

Question 195:

If an investor's certainty equivalent is greater than the expected value of an investment alternative, the investor is said to be:

A. Risk indifferent.

B. Risk averse.

C. Risk seeking.

D. Cautious.

-

Question 196:

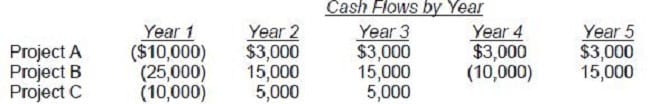

In considering the payback period for three projects, Fly Corp. gathered the following data about cash flows:

Which of the projects will achieve payback within three years?

A. Projects A, B, and C.

B. Projects B and C.

C. Project B only.

D. Projects A and C.

-

Question 197:

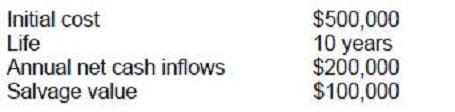

Harvey Co. is evaluating a capital investment proposal for a new machine. The investment proposal shows the following information:

If acquired, the machine will be depreciated using the straight-line method. The payback period for this investment is:

A. 3.25 years.

B. 2.67 years.

C. 2.5 years.

D. 2 years.

-

Question 198:

Net present value as used in investment decision-making is stated in terms of which of the following options?

A. Net income.

B. Earnings before interest, taxes, and depreciation.

C. Earnings before interest and taxes.

D. Cash flow.

-

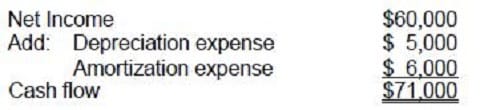

Question 199:

RLF Corporation had income before taxes of $60,000 for the year 1991. Included in this amount was depreciation of $5,000, a charge of $6,000 for the amortization of bond discounts, and $4,000 for interest expense. The estimated cash flow for the period is:

A. $66,000

B. $49,000

C. $71,000

D. $65,000

-

Question 200:

A depreciation tax shield is:

A. An after-tax cash outflow.

B. A reduction in income taxes.

C. The expense caused by depreciation.

D. Caused by the fact that depreciation does not affect cash flow.

Related Exams:

AACD

American Academy of Cosmetic DentistryACLS

Advanced Cardiac Life SupportASSET

ASSET Short Placement Tests Developed by ACTASSET-TEST

ASSET Short Placement Tests Developed by ACTBUSINESS-ENVIRONMENT-AND-CONCEPTS

Certified Public Accountant (Business Environment amd Concepts)CBEST-SECTION-1

California Basic Educational Skills Test - MathCBEST-SECTION-2

California Basic Educational Skills Test - ReadingCCE-CCC

Certified Cost Consultant / Cost Engineer (AACE International)CGFM

Certified Government Financial ManagerCGFNS

Commission on Graduates of Foreign Nursing Schools

Tips on How to Prepare for the Exams

Nowadays, the certification exams become more and more important and required by more and more enterprises when applying for a job. But how to prepare for the exam effectively? How to prepare for the exam in a short time with less efforts? How to get a ideal result and how to find the most reliable resources? Here on Vcedump.com, you will find all the answers. Vcedump.com provide not only Test Prep exam questions, answers and explanations but also complete assistance on your exam preparation and certification application. If you are confused on your BUSINESS-ENVIRONMENT-AND-CONCEPTS exam preparations and Test Prep certification application, do not hesitate to visit our Vcedump.com to find your solutions here.