Exam Details

Exam Code

:BUSINESS-ENVIRONMENT-AND-CONCEPTSExam Name

:Certified Public Accountant (Business Environment amd Concepts)Certification

:Test Prep CertificationsVendor

:Test PrepTotal Questions

:530 Q&AsLast Updated

:Apr 11, 2025

Test Prep Test Prep Certifications BUSINESS-ENVIRONMENT-AND-CONCEPTS Questions & Answers

-

Question 201:

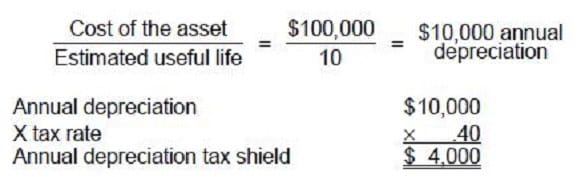

Wendy's Sandwich Shop purchased an asset for $100,000 that has no salvage value and a 10-year life. Wendy's effective income tax rate is 40 percent, and it uses the straight-line depreciation method for income tax reporting purposes. Wendy's annual depreciation tax shield from the asset would be:

A. $10,000

B. $6,000

C. $4,000

D. $2,000

-

Question 202:

Which of the following statements is true regarding the payback method?

A. It does not consider the time value of money.

B. It is the time required to recover the investment and earn a profit.

C. It is a measure of how profitable one investment project is compared to another.

D. The salvage value of old equipment is ignored in the event of equipment replacement.

-

Question 203:

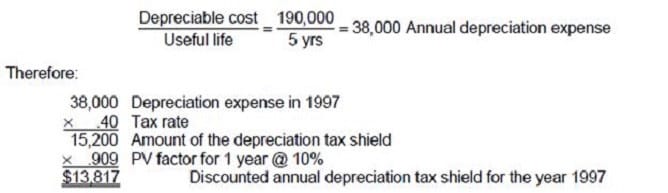

In order to increase production capacity, Gunning Industries is considering replacing an existing production machine with a new technologically improved machine effective January 1, 1997. The following information is being considered by Gunning Industries.

•

The new machine would be purchased for $160,000 in cash. Shipping, installation, and testing would cost

an additional $30,000.

•

The new machine is expected to increase annual sales by 20,000 units at a sales price of $40 per unit.

Incremental operating costs are comprised of $30 per unit in variable costs and total fixed costs of $40,000

per year.

•

The investment in the new machine will require an immediate increase in working capital of $35,000.

•

Gunning uses straight-line depreciation for financial reporting and tax reporting purposes. The new

machine has an estimated useful life of five years and zero salvage value.

•

Gunning is subject to a 40 percent corporate income tax rate.

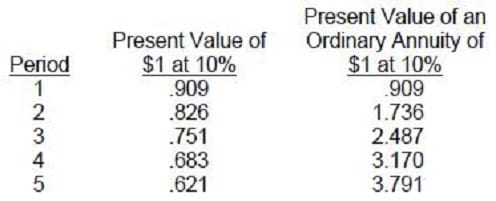

Gunning uses the net present value method to analyze investments and will employ the following factors

and rates.

Gunning Industries' discounted annual depreciation tax shield for the year 1997 would be:

A. $13,817

B. $15,200

C. $16,762

D. $20,725

-

Question 204:

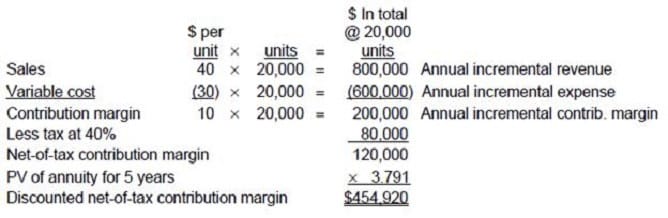

In order to increase production capacity, Gunning Industries is considering replacing an existing production machine with a new technologically improved machine effective January 1, 1997. The following information is being considered by Gunning Industries.

•

The new machine would be purchased for $160,000 in cash. Shipping, installation, and testing would cost

an additional $30,000.

•

The new machine is expected to increase annual sales by 20,000 units at a sales price of $40 per unit.

Incremental operating costs are comprised of $30 per unit in variable costs and total fixed costs of $40,000

per year.

•

The investment in the new machine will require an immediate increase in working capital of $35,000.

•

Gunning uses straight-line depreciation for financial reporting and tax reporting purposes. The new

machine has an estimated useful life of five years and zero salvage value.

•

Gunning is subject to a 40 percent corporate income tax rate.

Gunning uses the net present value method to analyze investments and will employ the following factors

and rates.

The acquisition of the new production machine by Gunning Industries will contribute a discounted net-oftax contribution margin of:

A. $242,624

B. $303,280

C. $363,936

D. $454,920

-

Question 205:

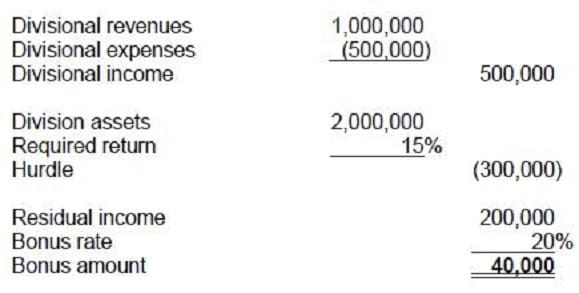

A divisional manager receives a bonus based on 20% of the residual income from the division. The results of the division include: Divisional revenues, $1,000,000; divisional expenses, $500,000; divisional assets, $2,000,000; and the required rate of return is 15%. What amount represents the manager's bonus?

A. $200,000

B. $140,000

C. $100,000

D. $40,000

-

Question 206:

A multiperiod project has a positive net present value. Which of the following statements is correct regarding its required rate of return?

A. Less than the company's weighted average cost of capital.

B. Less than the project's internal rate of return.

C. Greater than the company's weighted average cost of capital.

D. Greater than the project's internal rate of return.

-

Question 207:

A project's net present value, ignoring income tax considerations, is normally affected by the:

A. Proceeds from the sale of the asset to be replaced.

B. Carrying amount of the asset to be replaced by the project.

C. Amount of annual depreciation on the asset to be replaced.

D. Amount of annual depreciation on fixed assets used directly on the project.

-

Question 208:

Managers that anticipate greater return for greater risk are referred to as having what attitude toward risk?

A. Risk indifferent.

B. Risk averse.

C. Risk seeking.

D. Cautious.

-

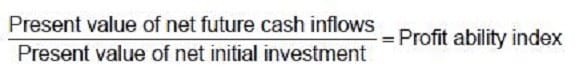

Question 209:

The profitability index is a variation on which of the following capital budgeting models?

A. Internal rate of return.

B. Economic value-added.

C. Net present value.

D. Discounted payback.

-

Question 210:

In evaluating a capital budget project, the use of the net present value model is generally not affected by the:

A. Method of funding the project.

B. Initial cost of the project.

C. Amount of added working capital needed for operations during the term of the project.

D. Amount of the project's associated depreciation tax allowance.

Related Exams:

AACD

American Academy of Cosmetic DentistryACLS

Advanced Cardiac Life SupportASSET

ASSET Short Placement Tests Developed by ACTASSET-TEST

ASSET Short Placement Tests Developed by ACTBUSINESS-ENVIRONMENT-AND-CONCEPTS

Certified Public Accountant (Business Environment amd Concepts)CBEST-SECTION-1

California Basic Educational Skills Test - MathCBEST-SECTION-2

California Basic Educational Skills Test - ReadingCCE-CCC

Certified Cost Consultant / Cost Engineer (AACE International)CGFM

Certified Government Financial ManagerCGFNS

Commission on Graduates of Foreign Nursing Schools

Tips on How to Prepare for the Exams

Nowadays, the certification exams become more and more important and required by more and more enterprises when applying for a job. But how to prepare for the exam effectively? How to prepare for the exam in a short time with less efforts? How to get a ideal result and how to find the most reliable resources? Here on Vcedump.com, you will find all the answers. Vcedump.com provide not only Test Prep exam questions, answers and explanations but also complete assistance on your exam preparation and certification application. If you are confused on your BUSINESS-ENVIRONMENT-AND-CONCEPTS exam preparations and Test Prep certification application, do not hesitate to visit our Vcedump.com to find your solutions here.