Exam Details

Exam Code

:BUSINESS-ENVIRONMENT-AND-CONCEPTSExam Name

:Certified Public Accountant (Business Environment amd Concepts)Certification

:Test Prep CertificationsVendor

:Test PrepTotal Questions

:530 Q&AsLast Updated

:Apr 11, 2025

Test Prep Test Prep Certifications BUSINESS-ENVIRONMENT-AND-CONCEPTS Questions & Answers

-

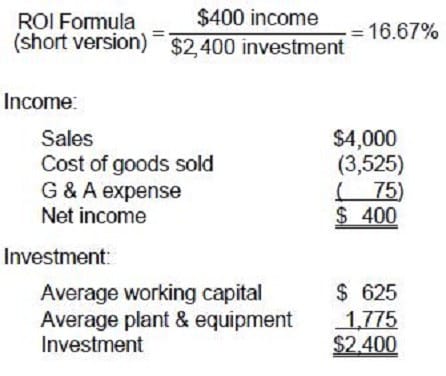

Question 181:

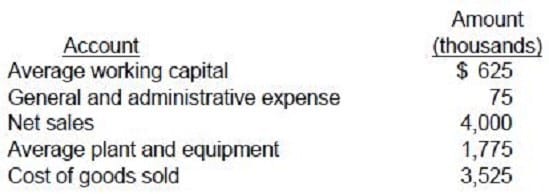

Listed below is selected financial information for the Western Division of the Hinzel Company for last year.

If Hinzel treats the Western Division as an investment center for performance measurement purposes, what is the before-tax return on investment for last year?

A. 26.76 percent.

B. 22.54 percent.

C. 19.79 percent.

D. 16.67 percent.

-

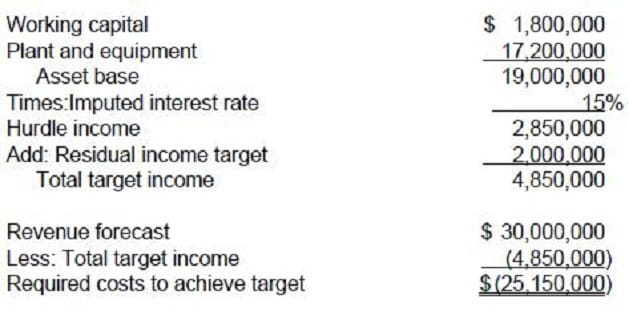

Question 182:

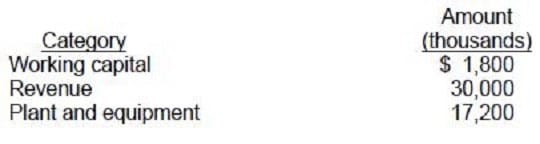

James Webb is the general manager of the Industrial Product Division, and his performance is measured using the residual income method. Webb is reviewing the following forecasted information for his division for next year.

If the imputed interest charge is 15 percent and Webb wants to achieve a residual income target of $2 million, what will costs have to be in order to achieve the target?

A. $10,800,000

B. $23,620,000

C. $25,150,000

D. $25,690,000

-

Question 183:

The segment margin of an investment center after deducting the imputed interest on the assets used by the investment center is known as:

A. Return on investment.

B. Residual income.

C. Operating income.

D. Return on assets.

-

Question 184:

The theory underlying the cost of capital is primarily concerned with the cost of:

A. Long-term funds and old funds.

B. Short-term funds and new funds.

C. Long-term funds and new funds.

D. Any combination of old or new, short-term or long-term funds.

-

Question 185:

Which one of a firm's sources of new capital usually has the lowest after tax cost?

A. Retained earnings.

B. Bonds.

C. Preferred stock.

D. Common stock.

-

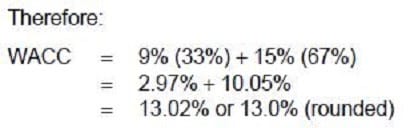

Question 186:

Youngsten Electric is contemplating new projects for the next year that will require $30,000,000 of new financing. In keeping with its capital structure, Youngsten plans to use debt and equity financing as follows:

•

Issue $10,000,000 of 20-year bonds at a price of 101.5, with a coupon of 10%, and flotation costs of 2.5% of par value.

•

Use internal funds generated from earnings of $20,000,000.

The equity market is expected to earn 15%. U.S. treasury bonds currently are yielding 9%. The beta coefficient for Youngsten's common stock is estimated to be .8. Youngsten is subject to a 40% corporate income tax rate. Youngsten has a price/earnings ratio of 10, a constant dividend payout ratio of 40%, and an expected growth rate of 12%.

Assume Youngsten has an after-tax cost of debt of 9% and an after-tax cost of equity of 15%. Youngsten's weighted average cost of capital is:

A. 11.0%

B. 13.0%

C. 12.0%

D. 11.8%

-

Question 187:

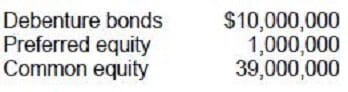

Sylvan Corporation has the following capital structure:

The financial leverage of Sylvan Corp. would increase as a result of:

A. Issuing common stock and using the proceeds to retire preferred stock.

B. Issuing common stock and using the proceeds to retire debenture bonds.

C. Financing its future investments with a higher percentage of bonds.

D. Financing its future investments with a higher percentage of equity funds.

-

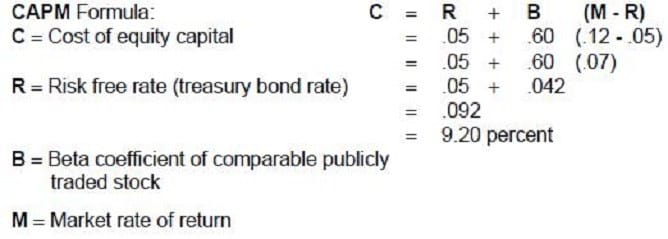

Question 188:

DQZ Telecom is considering a project for the coming year, which will cost $50 million. DQZ plans to use the following combination of debt and equity to finance the investment.

•

Issue $15 million of 20-year bonds at a price of 101, with a coupon rate of 8 percent, and flotation costs of

2 percent of par.

•

Use $35 million of funds generated from earnings.

The equity market is expected to earn 12 percent. U.S. treasury bonds are currently yielding 5 percent.

The beta coefficient for DQZ is estimated to be .60. DQZ is subject to an effective corporate income tax rate of 40 percent. The Capital Asset Pricing Model (CAPM) computes the expected return on a security by adding the riskfree rate of return to the incremental yield of the expected market return, which is adjusted by the company's beta. Compute DQZ's expected rate of return.

A. 9.20 percent.

B. 12.20 percent.

C. 7.20 percent.

D. 10.00 percent.

-

Question 189:

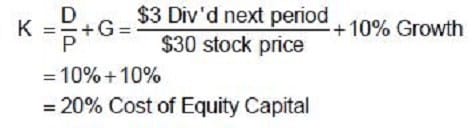

By using the discounted cash flow model, estimate the cost of equity capital for a firm with a stock price of $30.00, an estimated dividend at the end of the first year of $3.00 per share, and an expected growth rate of 10 percent.

A. 21.1 percent.

B. 12.2 percent.

C. 11.0 percent.

D. 20.0 percent.

-

Question 190:

Which one of the following factors might cause a firm to increase the debt in its financial structure?

A. An increase in the corporate income tax rate.

B. Increased economic uncertainty.

C. An increase in the price/earnings ratio.

D. A decrease in the times interest earned ratio.

Related Exams:

AACD

American Academy of Cosmetic DentistryACLS

Advanced Cardiac Life SupportASSET

ASSET Short Placement Tests Developed by ACTASSET-TEST

ASSET Short Placement Tests Developed by ACTBUSINESS-ENVIRONMENT-AND-CONCEPTS

Certified Public Accountant (Business Environment amd Concepts)CBEST-SECTION-1

California Basic Educational Skills Test - MathCBEST-SECTION-2

California Basic Educational Skills Test - ReadingCCE-CCC

Certified Cost Consultant / Cost Engineer (AACE International)CGFM

Certified Government Financial ManagerCGFNS

Commission on Graduates of Foreign Nursing Schools

Tips on How to Prepare for the Exams

Nowadays, the certification exams become more and more important and required by more and more enterprises when applying for a job. But how to prepare for the exam effectively? How to prepare for the exam in a short time with less efforts? How to get a ideal result and how to find the most reliable resources? Here on Vcedump.com, you will find all the answers. Vcedump.com provide not only Test Prep exam questions, answers and explanations but also complete assistance on your exam preparation and certification application. If you are confused on your BUSINESS-ENVIRONMENT-AND-CONCEPTS exam preparations and Test Prep certification application, do not hesitate to visit our Vcedump.com to find your solutions here.