Exam Details

Exam Code

:BUSINESS-ENVIRONMENT-AND-CONCEPTSExam Name

:Certified Public Accountant (Business Environment amd Concepts)Certification

:Test Prep CertificationsVendor

:Test PrepTotal Questions

:530 Q&AsLast Updated

:Apr 11, 2025

Test Prep Test Prep Certifications BUSINESS-ENVIRONMENT-AND-CONCEPTS Questions & Answers

-

Question 51:

Which one of the following responses is not an advantage to a corporation that uses the commercial paper market for short-term financing?

A. The borrower avoids the expense of maintaining a compensating balance with a commercial bank.

B. There are no restrictions as to the type of corporation that can enter into this market.

C. This market provides a broad distribution for borrowing.

D. A benefit accrues to the borrower because its name becomes more widely known.

-

Question 52:

All of the following are alternative marketable securities suitable for investment, except:

A. Eurodollars.

B. Commercial paper.

C. Bankers' acceptances.

D. Convertible bonds.

-

Question 53:

Which one of the following is not a characteristic of a negotiable certificate of deposit? Negotiable certificates of deposit:

A. Have a secondary market for investors.

B. Are regulated by the Federal Reserve System.

C. Are usually sold in denominations of a minimum of $100,000.

D. Have yields considerably greater than bankers' acceptances and commercial paper.

-

Question 54:

Commercial paper:

A. Has a maturity date greater than one year.

B. Is generally sold only through investment banking dealers.

C. Generally does not have an active secondary market.

D. Has an interest rate lower than treasury bills.

-

Question 55:

Which one of the following statements concerning cash discounts is correct?

A. The cost of not taking a 2/10, net 30 cash discount is usually less than the prime rate.

B. With trade terms of 2/15, net 60, if the discount is not taken, the buyer receives 45 days of free credit.

C. The cost of not taking the discount is higher for terms of 2/10, net 60 than for 2/10, net 30.

D. The cost of not taking a cash discount is generally higher than the cost of a bank loan.

-

Question 56:

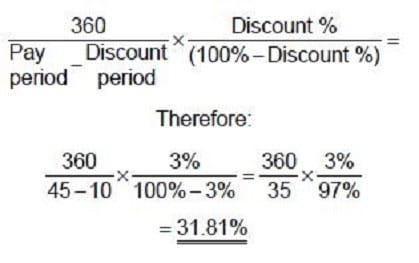

Using a 360-day year, what is the opportunity cost to a buyer of not accepting terms 3/10, net 45?

A. 55.67 percent.

B. 31.81 percent.

C. 15.43 percent.

D. 24.00 percent.

-

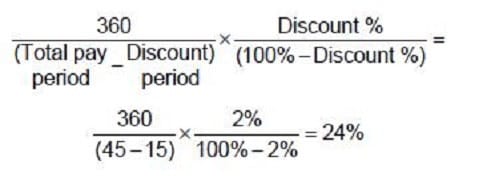

Question 57:

If a firm's credit terms require payment within 45 days but allow a discount of 2 percent if paid within 15 days (using a 360 day year), the approximate cost/benefit of the trade credit terms is:

A. 16 percent.

B. 48 percent.

C. 24 percent.

D. 36 percent.

-

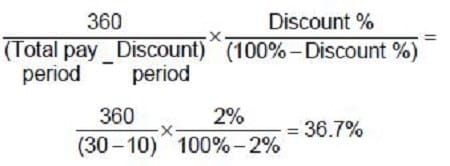

Question 58:

When a company offers credit terms of 2/10, net 30, the annual interest cost, based on a 360-day year, is:

A. 24.0 percent.

B. 35.3 percent.

C. 36.0 percent.

D. 36.7 percent.

-

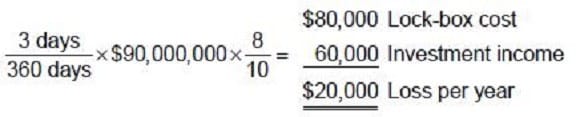

Question 59:

Foster Inc. is considering implementing a lock-box collection system at a cost of $80,000 per year. Annual sales are $90 million, and the lock-box system will reduce collection time by 3 days. If Foster can invest funds at 8 percent, should it use the lock-box system? Assume a 360-day year.

A. Yes, producing savings of $60,000 per year.

B. No, producing a loss of $20,000 per year.

C. No, producing a loss of $60,000 per year.

D. No, producing a loss of $140,000 per year.

-

Question 60:

Which one of the following represents methods for converting accounts receivable to cash?

A. Trade discounts, collection agencies, and credit approval.

B. Factoring, pledging, and electronic funds transfers.

C. Cash discounts, collection agencies, and electronic funds transfers.

D. Trade discounts, cash discounts, and electronic funds transfers.

Related Exams:

AACD

American Academy of Cosmetic DentistryACLS

Advanced Cardiac Life SupportASSET

ASSET Short Placement Tests Developed by ACTASSET-TEST

ASSET Short Placement Tests Developed by ACTBUSINESS-ENVIRONMENT-AND-CONCEPTS

Certified Public Accountant (Business Environment amd Concepts)CBEST-SECTION-1

California Basic Educational Skills Test - MathCBEST-SECTION-2

California Basic Educational Skills Test - ReadingCCE-CCC

Certified Cost Consultant / Cost Engineer (AACE International)CGFM

Certified Government Financial ManagerCGFNS

Commission on Graduates of Foreign Nursing Schools

Tips on How to Prepare for the Exams

Nowadays, the certification exams become more and more important and required by more and more enterprises when applying for a job. But how to prepare for the exam effectively? How to prepare for the exam in a short time with less efforts? How to get a ideal result and how to find the most reliable resources? Here on Vcedump.com, you will find all the answers. Vcedump.com provide not only Test Prep exam questions, answers and explanations but also complete assistance on your exam preparation and certification application. If you are confused on your BUSINESS-ENVIRONMENT-AND-CONCEPTS exam preparations and Test Prep certification application, do not hesitate to visit our Vcedump.com to find your solutions here.