Exam Details

Exam Code

:BUSINESS-ENVIRONMENT-AND-CONCEPTSExam Name

:Certified Public Accountant (Business Environment amd Concepts)Certification

:Test Prep CertificationsVendor

:Test PrepTotal Questions

:530 Q&AsLast Updated

:Apr 11, 2025

Test Prep Test Prep Certifications BUSINESS-ENVIRONMENT-AND-CONCEPTS Questions & Answers

-

Question 61:

Hagar Company's bank requires a compensating balance of 20 percent on a $100,000 loan. If the stated interest on the loan is 7 percent, what is the effective cost of the loan?

A. 7.00 percent.

B. 8.18 percent.

C. 8.40 percent.

D. 8.75 percent.

-

Question 62:

A working capital technique that increases the payable float and, therefore, delays the outflow of cash is:

A. Concentration banking.

B. A draft.

C. A lock-box system.

D. The use of a local post office box.

-

Question 63:

The collection of accounts receivable can be accelerated by the use of:

A. Turnaround documents.

B. A lockbox system.

C. Bank drafts.

D. Remittance advices.

-

Question 64:

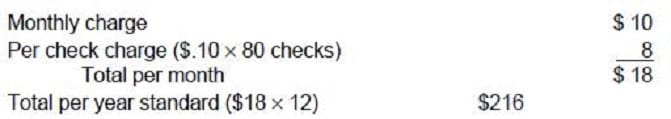

Kemple Cleaning Services is a newly established janitorial firm, and the owner is deciding which type of checking account to open. Kemple is planning to keep a $500 minimum balance in the account for emergencies and plans to write an average of 80 checks per month. The bank charges $10 per month plus a $0.10 per check charge for a standard business checking account with no minimum balance. Kemple also has the option of a premium business checking account, which requires a $2,500 minimum balance but has no monthly fees or per check charges. If Kemple's cost of funds is 10 percent, which account should Kemple choose?

A. Standard account, since the savings is $34 per year.

B. Premium account, since the savings is $34 per year.

C. Standard account, since the savings is $16 per year.

D. Premium account, since the savings is $16 per year.

-

Question 65:

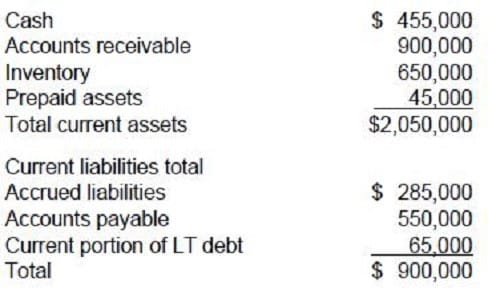

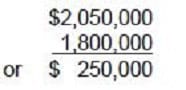

MFC Corporation has 100,000 shares of stock outstanding. Below is part of MFC's Statement of Financial Position for the last fiscal year.

What is the maximum amount MFC can pay in cash dividends per share and maintain a minimum current ratio of 2 to 1? Assume that all accounts other than cash remain unchanged.

A. $2.05

B. $2.50

C. $3.35

D. $3.80

-

Question 66:

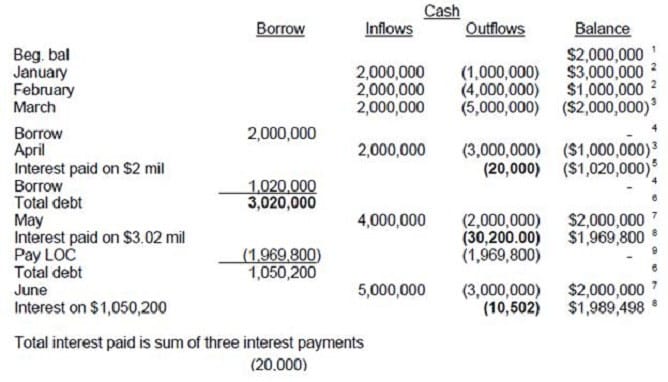

The treasury analyst for Garth Manufacturing has estimated the cash flows for the first half of next year (ignoring any short-term borrowings) as follows:

Garth has a line of credit of up to $4 million on which it pays interest monthly at a rate of 1 percent of the amount utilized. Garth is expected to have a cash balance of $2 million on January 1 and no amount utilized on its line of credit. Assuming all cash flows occur at the end of the month, approximately how much will Garth pay in interest during the first half of the year?

A. $61,000

B. $80,000

C. $132,000

D. $240,000

-

Question 67:

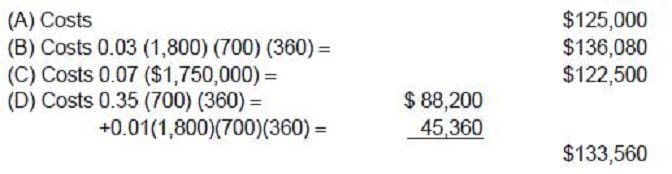

Newman Products has received proposals from several banks to establish a lockbox system to speed up receipts. Newman receives an average of 700 checks per day averaging $1,800 each, and its cost of short-term funds is 7 percent per year. Assuming that all proposals will produce equivalent processing results and using a 360-day year, which one of the following proposals is optimal for Newman?

A. A flat fee of $125,000 per year.

B. A fee of 0.03 percent of the amount collected.

C. A compensating balance of $1,750,000.

D. A fee of $0.35 per check plus 0.01 percent of the amount collected.

-

Question 68:

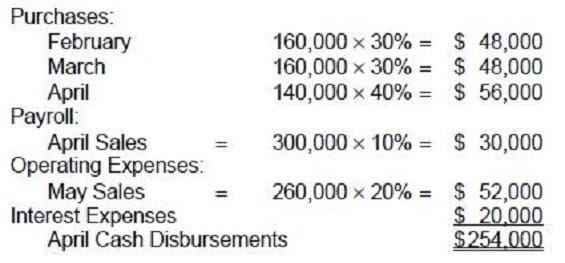

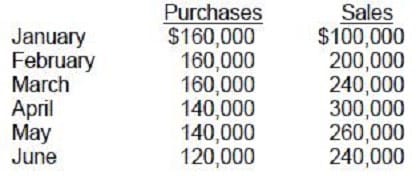

The following information applies to Brandon Company.

Forty percent of purchases are paid for in cash at the time of purchase, and 30 percent is paid for in each of the next two months. Purchases for the previous November and December were $150,000 per month. Payroll is 10 percent of sales in the month it occurs, and operating expenses are 20 percent of the following months sales (July sales were $220,000). Interest payments were $20,000 paid quarterly in January and April. Brandon's cash disbursements for the month of April were:

A. $152,000

B. $200,000

C. $248,000

D. $254,000

-

Question 69:

A firm can best delay disbursements through the use of:

A. A centralized disbursement function.

B. Drafts.

C. Factoring.

D. Trade discounts.

-

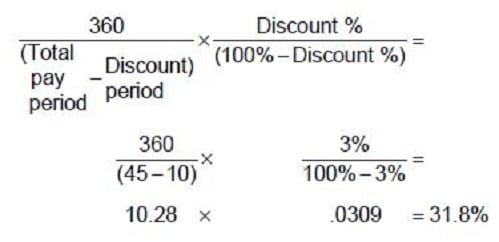

Question 70:

Wyley Inc. purchases an item on credit with terms of 3/10, net 45. Based on a 360-day year, Wyley's annual interest cost of foregoing the cash discount and making payment on the last day of the credit period is:

A. 24.00%

B. 30.86%

C. 31.81%

D. 37.11%

Related Exams:

AACD

American Academy of Cosmetic DentistryACLS

Advanced Cardiac Life SupportASSET

ASSET Short Placement Tests Developed by ACTASSET-TEST

ASSET Short Placement Tests Developed by ACTBUSINESS-ENVIRONMENT-AND-CONCEPTS

Certified Public Accountant (Business Environment amd Concepts)CBEST-SECTION-1

California Basic Educational Skills Test - MathCBEST-SECTION-2

California Basic Educational Skills Test - ReadingCCE-CCC

Certified Cost Consultant / Cost Engineer (AACE International)CGFM

Certified Government Financial ManagerCGFNS

Commission on Graduates of Foreign Nursing Schools

Tips on How to Prepare for the Exams

Nowadays, the certification exams become more and more important and required by more and more enterprises when applying for a job. But how to prepare for the exam effectively? How to prepare for the exam in a short time with less efforts? How to get a ideal result and how to find the most reliable resources? Here on Vcedump.com, you will find all the answers. Vcedump.com provide not only Test Prep exam questions, answers and explanations but also complete assistance on your exam preparation and certification application. If you are confused on your BUSINESS-ENVIRONMENT-AND-CONCEPTS exam preparations and Test Prep certification application, do not hesitate to visit our Vcedump.com to find your solutions here.