Exam Details

Exam Code

:BUSINESS-ENVIRONMENT-AND-CONCEPTSExam Name

:Certified Public Accountant (Business Environment amd Concepts)Certification

:Test Prep CertificationsVendor

:Test PrepTotal Questions

:530 Q&AsLast Updated

:Apr 11, 2025

Test Prep Test Prep Certifications BUSINESS-ENVIRONMENT-AND-CONCEPTS Questions & Answers

-

Question 71:

An increase in sales collections resulting from an increased cash discount for prompt payment would be expected to cause a (n):

A. Increase in the operating cycle.

B. Increase in the average collection period.

C. Decrease in the cash conversion cycle.

D. Increase in bad debt losses.

-

Question 72:

When managing cash and short-term investments, a corporate treasurer is primarily concerned with:

A. Maximizing rate of return.

B. Minimizing taxes.

C. Investing in common stock due to the dividend exclusion for federal income tax purposes.

D. Liquidity and safety.

-

Question 73:

The working capital financing policy that subjects the firm to the greatest risk of being unable to meet the firm's maturing obligations is the policy that finances:

A. Fluctuating current assets with long-term debt.

B. Permanent current assets with long-term debt.

C. Permanent current assets with short-term debt.

D. Fluctuating current assets with short-term debt.

-

Question 74:

Which of the following transactions does not change the current ratio and does not change the total current assets?

A. A cash advance is made to a divisional office.

B. A cash dividend is declared.

C. Short-term notes payable are retired with cash.

D. Equipment is purchased with a three-year note and a 10 percent cash down payment.

-

Question 75:

As a company becomes more conservative in its working capital policy, it would tend to have a (n):

A. Decrease in its acid-test ratio.

B. Increase in the ratio of current assets to units of output.

C. Increase in funds invested in common stock and a decrease in funds invested in marketable securities.

D. Decrease in its level of permanent working capital.

-

Question 76:

Determining the appropriate level of working capital for a firm requires:

A. Changing the capital structure and dividend policy of the firm.

B. Maintaining short-term debt at the lowest possible level because it is generally more expensive than long-term debt.

C. Offsetting the benefit of current assets and current liabilities against the probability of technical insolvency.

D. Maintaining a high proportion of liquid assets to total assets in order to maximize the return on total investments.

-

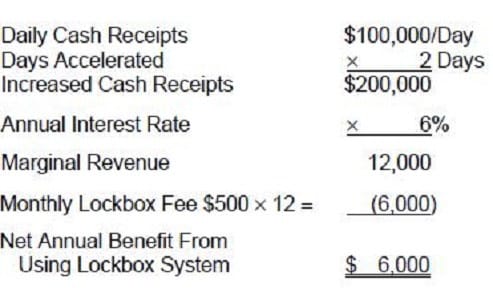

Question 77:

A firm has daily cash receipts of $100,000. A bank has offered to reduce the collection time on the firm's deposits by two days for a monthly fee of $500. If money market rates are expected to average 6 percent during the year, the net annual benefit (loss) from having this service is:

A. $3,000

B. $12,000

C. $6,000

D. $(6,000)

-

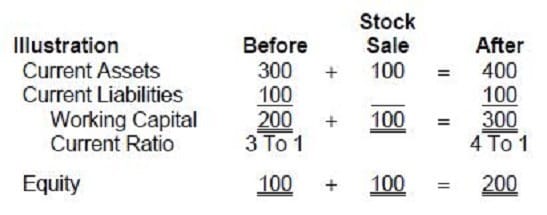

Question 78:

If a firm increases its cash balance by issuing additional shares of common stock, working capital:

A. Remains unchanged and the current ratio remains unchanged.

B. Increases and the current ratio remains unchanged.

C. Increases and the current ratio decreases.

D. Increases and the current ratio increases.

-

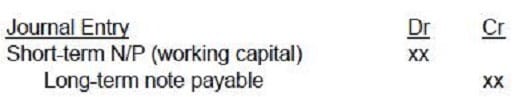

Question 79:

Which one of the following would increase the working capital of a firm?

A. Purchase of a new plant financed by a 20-year mortgage.

B. Cash collection of accounts receivable.

C. Payment of a 20-year mortgage payable with cash.

D. Refinancing a short-term note payable with a two-year note payable.

-

Question 80:

Net working capital is the difference between:

A. Current assets and current liabilities.

B. Fixed assets and fixed liabilities.

C. Total assets and total liabilities.

D. Total assets and current liabilities.

Related Exams:

AACD

American Academy of Cosmetic DentistryACLS

Advanced Cardiac Life SupportASSET

ASSET Short Placement Tests Developed by ACTASSET-TEST

ASSET Short Placement Tests Developed by ACTBUSINESS-ENVIRONMENT-AND-CONCEPTS

Certified Public Accountant (Business Environment amd Concepts)CBEST-SECTION-1

California Basic Educational Skills Test - MathCBEST-SECTION-2

California Basic Educational Skills Test - ReadingCCE-CCC

Certified Cost Consultant / Cost Engineer (AACE International)CGFM

Certified Government Financial ManagerCGFNS

Commission on Graduates of Foreign Nursing Schools

Tips on How to Prepare for the Exams

Nowadays, the certification exams become more and more important and required by more and more enterprises when applying for a job. But how to prepare for the exam effectively? How to prepare for the exam in a short time with less efforts? How to get a ideal result and how to find the most reliable resources? Here on Vcedump.com, you will find all the answers. Vcedump.com provide not only Test Prep exam questions, answers and explanations but also complete assistance on your exam preparation and certification application. If you are confused on your BUSINESS-ENVIRONMENT-AND-CONCEPTS exam preparations and Test Prep certification application, do not hesitate to visit our Vcedump.com to find your solutions here.