Exam Details

Exam Code

:FINANCIAL-ACCOUNTING-AND-REPORTINGExam Name

:Financial ReportingCertification

:Test Prep CertificationsVendor

:Test PrepTotal Questions

:163 Q&AsLast Updated

:Apr 14, 2025

Test Prep Test Prep Certifications FINANCIAL-ACCOUNTING-AND-REPORTING Questions & Answers

-

Question 41:

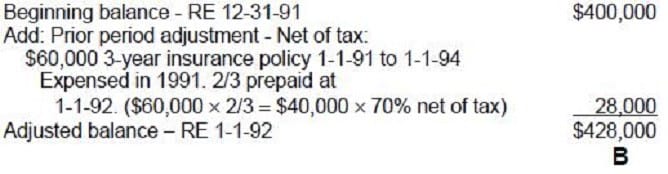

Conn Co. reported a retained earnings balance of $400,000 at December 31, 1991. In August 1992, Conn determined that insurance premiums of $60,000 for the three-year period beginning January 1, 1991, had been paid and fully expensed in 1991. Conn has a 30% income tax rate. What amount should Conn report as adjusted beginning retained earnings in its 1992 statement of retained earnings?

A. $420,000

B. $428,000

C. $440,000

D. $442,000

-

Question 42:

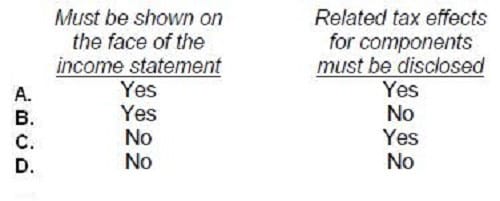

Which of the following is true regarding the presentation of "comprehensive income."

A. Option A

B. Option B

C. Option C

D. Option D

-

Question 43:

Reclassification adjustments must be shown in the financial statement that discloses comprehensive income:

A. To show what portion of comprehensive income is from the realization of current assets.

B. To show the tax effect of items of comprehensive income.

C. To avoid double counting in comprehensive income items, which are currently displayed in net income.

D. To avoid including transactions with shareholders in items of comprehensive income.

-

Question 44:

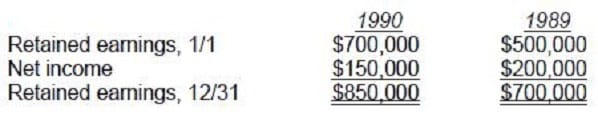

While preparing its 1991 financial statements, Dek Corp. discovered computational errors in its 1990 and 1989 depreciation expense. These errors resulted in overstatement of each year's income by $25,000, net of income taxes. The following amounts were reported in the previously issued financial statements: Dek's 1991 net income is correctly reported at $180,000. Which of the following amounts should be reported as prior period adjustments and net income in Dek's 1991 and 1990 comparative financial statements?

A. Option A

B. Option B

C. Option C

D. Option D

-

Question 45:

During 20X5, Dale Corp. made the following accounting changes:

What amount should be shown in the 20X5 retained earnings statement as an adjustment to the beginning balance?

A. $0

B. $30,000

C. $98,000

D. $128,000

-

Question 46:

Earnings per share data should be reported on the income statement for:

A. Option A

B. Option B

C. Option C

D. Option D

-

Question 47:

The effect of a change in accounting principle that is inseparable from the effect of a change in accounting estimate should be reported:

A. By restating the financial statements of all prior periods presented.

B. As a correction of an error.

C. As a component of income from continuing operations, in the period of change and future periods if the change affects both.

D. As a separate disclosure after income from continuing operations, in the period of change and future periods if the change affects both.

-

Question 48:

In single period statements, which of the following should not be reflected as an adjustment to the opening balance of retained earnings?

A. Effect of a failure to provide for uncollectible accounts in the previous period.

B. Effect of a decrease in the estimated useful life of depreciable equipment.

C. Cumulative effect of a change from the percentage of completion to the completed contract method of accounting for long-term construction projects.

D. Cumulative effect of a change from LIFO to FIFO in valuing merchandise inventory.

-

Question 49:

In 1990, Brighton Co. changed from the individual item approach to the aggregate approach in applying the lower of FIFO cost or market to inventories. The cumulative effect of this change should be reported in Brighton's financial statements as a:

A. Retrospective adjustment on the retained earnings statement, with separate disclosure.

B. Component of income from continuing operations, with separate disclosure.

C. Component of income from continuing operations, without separate disclosure.

D. Component of income after continuing operations, with separate disclosure.

-

Question 50:

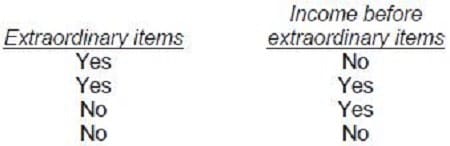

Is the cumulative effect of an inventory pricing change on prior years earnings reported on the financial statements for

A. Option A

B. Option B

C. Option C

D. Option D

Related Exams:

AACD

American Academy of Cosmetic DentistryACLS

Advanced Cardiac Life SupportASSET

ASSET Short Placement Tests Developed by ACTASSET-TEST

ASSET Short Placement Tests Developed by ACTBUSINESS-ENVIRONMENT-AND-CONCEPTS

Certified Public Accountant (Business Environment amd Concepts)CBEST-SECTION-1

California Basic Educational Skills Test - MathCBEST-SECTION-2

California Basic Educational Skills Test - ReadingCCE-CCC

Certified Cost Consultant / Cost Engineer (AACE International)CGFM

Certified Government Financial ManagerCGFNS

Commission on Graduates of Foreign Nursing Schools

Tips on How to Prepare for the Exams

Nowadays, the certification exams become more and more important and required by more and more enterprises when applying for a job. But how to prepare for the exam effectively? How to prepare for the exam in a short time with less efforts? How to get a ideal result and how to find the most reliable resources? Here on Vcedump.com, you will find all the answers. Vcedump.com provide not only Test Prep exam questions, answers and explanations but also complete assistance on your exam preparation and certification application. If you are confused on your FINANCIAL-ACCOUNTING-AND-REPORTING exam preparations and Test Prep certification application, do not hesitate to visit our Vcedump.com to find your solutions here.