Exam Details

Exam Code

:FINANCIAL-ACCOUNTING-AND-REPORTINGExam Name

:Financial ReportingCertification

:Test Prep CertificationsVendor

:Test PrepTotal Questions

:163 Q&AsLast Updated

:Apr 14, 2025

Test Prep Test Prep Certifications FINANCIAL-ACCOUNTING-AND-REPORTING Questions & Answers

-

Question 61:

Gown, Inc. sold a warehouse and used the proceeds to acquire a new warehouse. The excess of the proceeds over the carrying amount of the warehouse sold should be reported as a(an):

A. Extraordinary gain, net of income taxes.

B. Part of continuing operations.

C. Gain from discontinued operations, net of income taxes.

D. Reduction of the cost of the new warehouse.

-

Question 62:

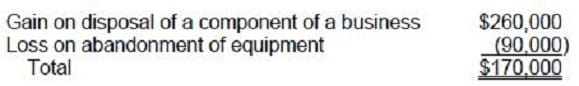

Adam Corp. had the following infrequent transactions during 1989:

•

A $190,000 gain on reacquisition and retirement of bonds. This material event is also considered unusual for Adam Corp.

•

A $260,000 gain on the disposal of a component of a business. Adam continues similar operations at another location.

•

A $90,000 loss on the abandonment of equipment.

In its 1989 income statement, what amount should Adam report as total infrequent net gains that are not considered extraordinary?

A. $100,000

B. $170,000

C. $360,000

D. $450,000

-

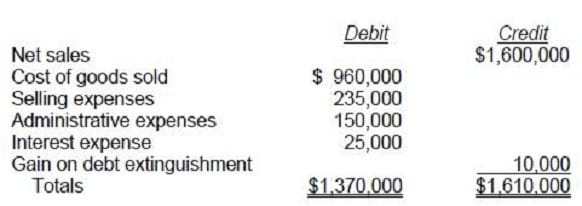

Question 63:

Coffey Corp.'s trial balance of Income Statement Accounts for the year ended December 31, 1988 as follows:

Coffey's income tax rate is 30%. The gain on debt extinguishment is considered a usual and recurring part

of Coffey's operations. Coffey prepares a multiple-step income statement for 1988.

Income from operations before income tax is:

A. $190,000

B. $200,000

C. $230,000

D. $240,000

-

Question 64:

Several sources of GAAP consulted by an auditor are in conflict as to the application of an accounting principle. Which of the following should the auditor consider the most authoritative?

A. FASB Technical Bulletins.

B. AICPA Accounting Interpretations.

C. FASB Statements of Financial Accounting Concepts.

D. AICPA Technical Practice Aids.

-

Question 65:

Which of the following information should be included in Melay, Inc.'s 1992 summary of significant accounting policies?

A. Property, plant, and equipment is recorded at cost with depreciation computed principally by the straight-line method.

B. During 1992, the Delay component was sold.

C. Business segment 1992 sales are Alay $1M, Belay $2M, and Celay $3M.

D. Future common share dividends are expected to approximate 60% of earnings.

-

Question 66:

The summary of significant accounting policies should disclose the:

A. Maturity dates of noncurrent debts.

B. Terms for convertible debt to be exchanged for common stock.

C. Concentration of credit risk of all financial instruments by geographical region.

D. Criteria for determining which investments are treated as cash equivalents.

-

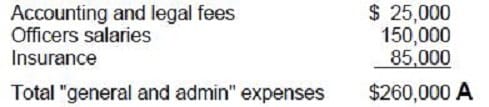

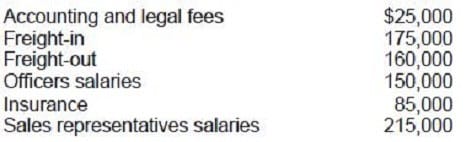

Question 67:

The following costs were incurred by Griff Co., a manufacturer, during 1992:

What amount of these costs should be reported as general and administrative expenses for 1992?

A. $260,000

B. $550,000

C. $635,000

D. $810,000

-

Question 68:

Which of the following accounting pronouncements is the most authoritative?

A. FASB Statement of Financial Accounting Concepts.

B. FASB Technical Bulletin.

C. AICPA Accounting Principles Board Opinion.

D. AICPA Statement of Position.

-

Question 69:

Which of the following should be disclosed in a summary of significant accounting policies?

I. Management's intention to maintain or vary the dividend payout ratio.

II. Criteria for determining which investments are treated as cash equivalents.

III.

Composition of the sales order backlog by segment.

A.

I only.

B.

I and III.

C.

II only.

D.

II and III.

-

Question 70:

On January 1, 1991, Brecon Co. installed cabinets to display its merchandise in customers' stores. Brecon expects to use these cabinets for five years. Brecon's 1991 multi-step income statement should include:

A. One-fifth of the cabinet costs in cost of goods sold.

B. One-fifth of the cabinet costs in selling, general, and administrative expenses.

C. All of the cabinet costs in cost of goods sold.

D. All of the cabinet costs in selling, general, and administrative expenses.

Related Exams:

AACD

American Academy of Cosmetic DentistryACLS

Advanced Cardiac Life SupportASSET

ASSET Short Placement Tests Developed by ACTASSET-TEST

ASSET Short Placement Tests Developed by ACTBUSINESS-ENVIRONMENT-AND-CONCEPTS

Certified Public Accountant (Business Environment amd Concepts)CBEST-SECTION-1

California Basic Educational Skills Test - MathCBEST-SECTION-2

California Basic Educational Skills Test - ReadingCCE-CCC

Certified Cost Consultant / Cost Engineer (AACE International)CGFM

Certified Government Financial ManagerCGFNS

Commission on Graduates of Foreign Nursing Schools

Tips on How to Prepare for the Exams

Nowadays, the certification exams become more and more important and required by more and more enterprises when applying for a job. But how to prepare for the exam effectively? How to prepare for the exam in a short time with less efforts? How to get a ideal result and how to find the most reliable resources? Here on Vcedump.com, you will find all the answers. Vcedump.com provide not only Test Prep exam questions, answers and explanations but also complete assistance on your exam preparation and certification application. If you are confused on your FINANCIAL-ACCOUNTING-AND-REPORTING exam preparations and Test Prep certification application, do not hesitate to visit our Vcedump.com to find your solutions here.