Exam Details

Exam Code

:FINANCIAL-ACCOUNTING-AND-REPORTINGExam Name

:Financial ReportingCertification

:Test Prep CertificationsVendor

:Test PrepTotal Questions

:163 Q&AsLast Updated

:Apr 14, 2025

Test Prep Test Prep Certifications FINANCIAL-ACCOUNTING-AND-REPORTING Questions & Answers

-

Question 71:

Under FASB Statement of Financial Accounting Concepts #5, which of the following items would cause earnings to differ from comprehensive income for an enterprise in an industry not having specialized accounting principles?

A. Unrealized loss on investments in noncurrent marketable equity securities available for sale.

B. Unrealized loss on investments in current marketable equity securities held for trading.

C. Loss on exchange of nonmonetary assets without commercial substance.

D. Loss on exchange of nonmonetary assets with commercial substance.

-

Question 72:

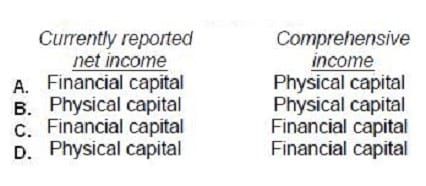

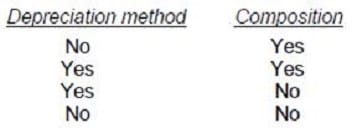

FASB's conceptual framework explains both financial and physical capital maintenance concepts. Which capital maintenance concept is applied to currently reported net income, and which is applied to comprehensive income?

A. Option A

B. Option B

C. Option C

D. Option D

-

Question 73:

According to the FASB conceptual framework, which of the following is an essential characteristic of an asset?

A. The claims to an asset's benefits are legally enforceable.

B. An asset is tangible.

C. An asset is obtained at a cost.

D. An asset provides future benefits.

-

Question 74:

According to the FASB conceptual framework, an entity's revenue may result from:

A. A decrease in an asset from primary operations.

B. An increase in an asset from incidental transactions.

C. An increase in a liability from incidental transactions.

D. A decrease in a liability from primary operations.

-

Question 75:

Which of the following facts concerning fixed assets should be included in the summary of significant accounting policies?

A. Option A

B. Option B

C. Option C

D. Option D

-

Question 76:

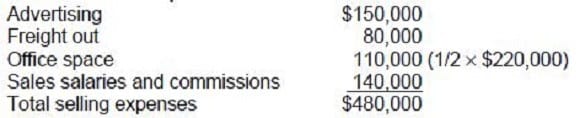

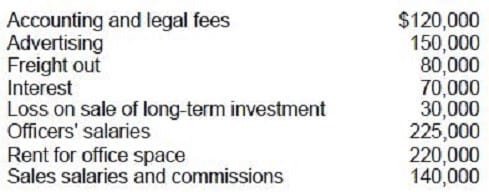

Brock Corp. reports operating expenses in two categories: (1) selling and (2) general and administrative. The adjusted trial balance at December 31, 1989 included the following expense and loss accounts: One-half of the rented premises is occupied by the sales department. Brock's total selling expenses for 1989 are:

A. $480,000

B. $400,000

C. $370,000

D. $360,000

-

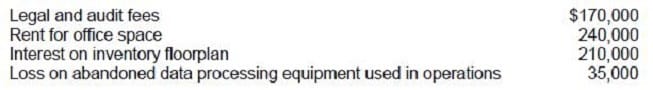

Question 77:

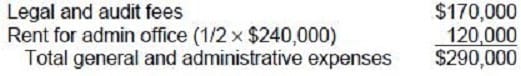

The following items were among those that were reported on Lee Co.'s income statement for the year ended December 31, 1989:

The office space is used equally by Lee's sales and accounting departments. What amount of the abovelisted items should be classified as general and administrative expenses in Lee's multiple-step income statement?

A. $290,000

B. $325,000

C. $410,000

D. $500,000

-

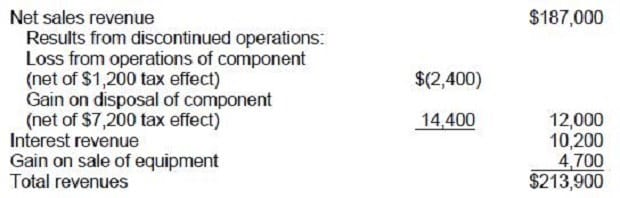

Question 78:

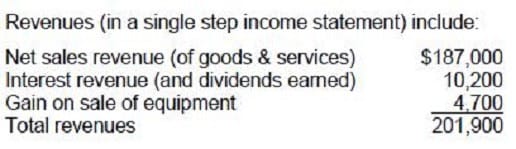

In Baer Food Co.'s 1990 single-step income statement, the section titled "Revenues" consisted of the following:

In the revenues section of its 1990 income statement, Baer Food should have reported total revenues of:

A. $216,300

B. $215,400

C. $203,700

D. $201,900

-

Question 79:

FASB Interpretations of Statements of Financial Accounting Standards have the same authority as the FASB:

A. Statements of Financial Accounting Concepts.

B. Emerging Issues Task Force Consensus.

C. Technical Bulletins.

D. Statements of Financial Accounting Standards.

-

Question 80:

According to the FASB's conceptual framework, the process of reporting an item in the financial statements of an entity is:

A. Recognition.

B. Realization.

C. Allocation.

D. Matching.

Related Exams:

AACD

American Academy of Cosmetic DentistryACLS

Advanced Cardiac Life SupportASSET

ASSET Short Placement Tests Developed by ACTASSET-TEST

ASSET Short Placement Tests Developed by ACTBUSINESS-ENVIRONMENT-AND-CONCEPTS

Certified Public Accountant (Business Environment amd Concepts)CBEST-SECTION-1

California Basic Educational Skills Test - MathCBEST-SECTION-2

California Basic Educational Skills Test - ReadingCCE-CCC

Certified Cost Consultant / Cost Engineer (AACE International)CGFM

Certified Government Financial ManagerCGFNS

Commission on Graduates of Foreign Nursing Schools

Tips on How to Prepare for the Exams

Nowadays, the certification exams become more and more important and required by more and more enterprises when applying for a job. But how to prepare for the exam effectively? How to prepare for the exam in a short time with less efforts? How to get a ideal result and how to find the most reliable resources? Here on Vcedump.com, you will find all the answers. Vcedump.com provide not only Test Prep exam questions, answers and explanations but also complete assistance on your exam preparation and certification application. If you are confused on your FINANCIAL-ACCOUNTING-AND-REPORTING exam preparations and Test Prep certification application, do not hesitate to visit our Vcedump.com to find your solutions here.