Exam Details

Exam Code

:FINANCIAL-ACCOUNTING-AND-REPORTINGExam Name

:Financial ReportingCertification

:Test Prep CertificationsVendor

:Test PrepTotal Questions

:163 Q&AsLast Updated

:Apr 14, 2025

Test Prep Test Prep Certifications FINANCIAL-ACCOUNTING-AND-REPORTING Questions & Answers

-

Question 81:

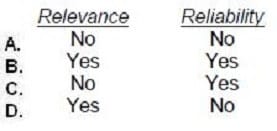

According to the FASB conceptual framework, predictive value is an ingredient of:

A. Option A

B. Option B

C. Option C

D. Option D

-

Question 82:

According to the FASB conceptual framework, the objectives of financial reporting for business enterprises are based on:

A. The need for conservatism.

B. Reporting on management's stewardship.

C. Generally accepted accounting principles.

D. The needs of the users of the information.

-

Question 83:

A change from the cost approach to the market approach of measuring fair value is considered to be what type of accounting change?

A. Change in accounting estimate.

B. Change in accounting principle.

C. Change in valuation technique.

D. Error correction.

-

Question 84:

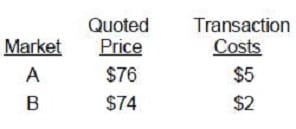

There are multiple active markets for a financial asset with different observable market prices: There is no principal market for the financial asset. What is the fair value of the asset?

A. $71

B. $72

C. $74

D. $76

-

Question 85:

Which of the following statements is incorrect regarding the inputs that can be used to measure fair value?

I. Level I inputs are the most reliable fair value measurements and Level III inputs are the least reliable.

II. Level I measurements are quoted prices in active markets for identical or similar assets or liabilities.

III. A fair value measurement based on management assumptions only (no market data) would not be acceptable per GAAP.

IV.

The level in the fair value hierarchy of a fair value measurement is determined by the level of the highest level significant input.

A.

I only.

B.

I, II, IV.

C.

II, III, IV.

D.

I, II, III, IV.

-

Question 86:

Which of the following is not a valuation technique that can be used to measure the fair value of an asset or liability?

A. The market approach.

B. The impairment approach.

C. The income approach.

D. The cost approach.

-

Question 87:

Which of the following factors determines whether an identified segment of an enterprise should be reported in the enterprise's financial statements under SFAS No. 131, Disclosures about Segments of an Enterprise and Related Information?

I. The segment's assets constitute more than 10% of the combined assets of all operating segments.

II.

The segment's liabilities constitute more than 10% of the combined liabilities of all operating segments.

A.

I only.

B.

II only.

C.

Both I and II.

D.

Neither I nor II.

-

Question 88:

Which of the following types of entities are required to report on business segments?

A. Nonpublic business enterprises.

B. Publicly-traded enterprises.

C. Not-for-profit enterprises.

D. Joint ventures.

-

Question 89:

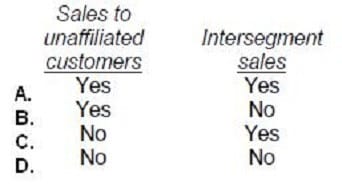

In financial reporting of segment data, which of the following must be considered in determining if an industry segment is a reportable segment?

A. Option A

B. Option B

C. Option C

D. Option D

-

Question 90:

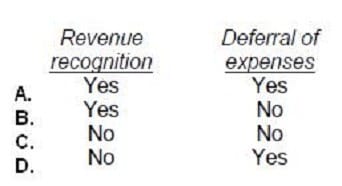

A development stage enterprise should use the same generally accepted accounting principles that apply to established operating enterprises for:

A. Option A

B. Option B

C. Option C

D. Option D

Related Exams:

AACD

American Academy of Cosmetic DentistryACLS

Advanced Cardiac Life SupportASSET

ASSET Short Placement Tests Developed by ACTASSET-TEST

ASSET Short Placement Tests Developed by ACTBUSINESS-ENVIRONMENT-AND-CONCEPTS

Certified Public Accountant (Business Environment amd Concepts)CBEST-SECTION-1

California Basic Educational Skills Test - MathCBEST-SECTION-2

California Basic Educational Skills Test - ReadingCCE-CCC

Certified Cost Consultant / Cost Engineer (AACE International)CGFM

Certified Government Financial ManagerCGFNS

Commission on Graduates of Foreign Nursing Schools

Tips on How to Prepare for the Exams

Nowadays, the certification exams become more and more important and required by more and more enterprises when applying for a job. But how to prepare for the exam effectively? How to prepare for the exam in a short time with less efforts? How to get a ideal result and how to find the most reliable resources? Here on Vcedump.com, you will find all the answers. Vcedump.com provide not only Test Prep exam questions, answers and explanations but also complete assistance on your exam preparation and certification application. If you are confused on your FINANCIAL-ACCOUNTING-AND-REPORTING exam preparations and Test Prep certification application, do not hesitate to visit our Vcedump.com to find your solutions here.