Exam Details

Exam Code

:BUSINESS-ENVIRONMENT-AND-CONCEPTSExam Name

:Certified Public Accountant (Business Environment amd Concepts)Certification

:Test Prep CertificationsVendor

:Test PrepTotal Questions

:530 Q&AsLast Updated

:Apr 11, 2025

Test Prep Test Prep Certifications BUSINESS-ENVIRONMENT-AND-CONCEPTS Questions & Answers

-

Question 151:

In inventory management, the safety stock will tend to increase if the:

A. Carrying cost increases.

B. Cost of running out of stock decreases.

C. Variability of lead-time increases.

D. Fixed order cost decreases.

-

Question 152:

As a company becomes more conservative with respect to working capital policy, it would tend to have a (n):

A. Increase in the ratio of current liabilities to noncurrent liabilities.

B. Decrease in the operating cycle.

C. Decrease in the quick ratio.

D. Increase in the ratio of current assets to noncurrent assets.

-

Question 153:

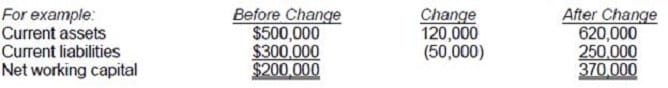

During 1990, Mason Company's current assets increased by $120, current liabilities decreased by $50, and net working capital:

A. Increased by $70.

B. Decreased by $170.

C. Increased by $170.

D. Decreased by $70.

-

Question 154:

The optimal level of inventory would be affected by all of the following, except the:

A. Cost per unit of inventory.

B. Current level of inventory.

C. Cost of placing an order for merchandise.

D. Lead time to receive merchandise ordered.

-

Question 155:

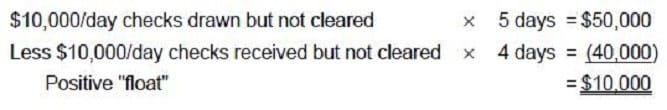

Assume that each day a company writes and receives checks totaling $10,000. If it takes five days for the checks to clear and be deducted from the company's account, and only four days for the deposits to clear, what is the float?

A. $10,000

B. $0

C. $(10,000)

D. $25,000

-

Question 156:

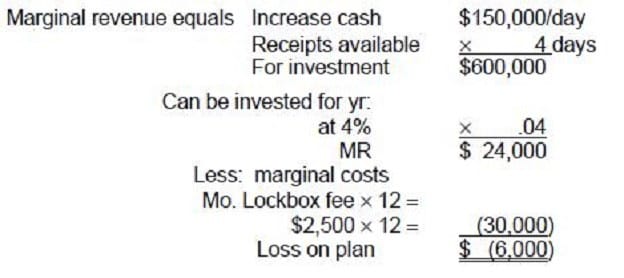

A company has daily cash receipts of $150,000. The treasurer of the company has investigated a lockbox service whereby the bank that offers this service will reduce the company's collection time by four days at a monthly fee of $2,500. If money market rates average four percent during the year, the additional annual income (loss) from using the lockbox service would be:

A. $6,000

B. $(6,000)

C. $12,000

D. $(12,000)

-

Question 157:

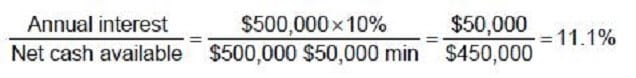

If a firm borrows $500,000 at 10 percent and is required to maintain $50,000 as a minimum compensating balance at the bank, what is the effective interest rate on the loan?

A. 11.1 percent.

B. 9.1 percent.

C. 12.2 percent.

D. 11.0 percent.

-

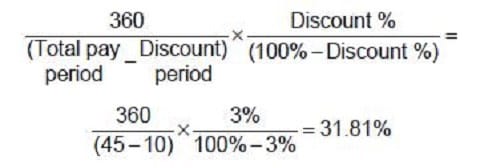

Question 158:

If a retailer's terms of trade are 3/10, net 45 with a particular supplier, what is the cost on an annual basis of not taking the discount? Assume a 360-day year.

A. 37.11 percent.

B. 36.00 percent.

C. 24.74 percent.

D. 31.81 percent.

-

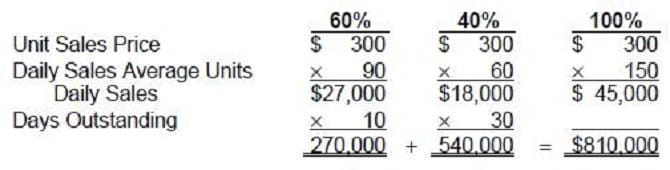

Question 159:

Jackson Distributors sells to retail stores on credit terms of 2/10, net 30. Daily sales average 150 units at a price of $300 each. Assuming that all sales are on credit and 60 percent of customers take the discount and pay on Day 10 while the rest of the customers pay on Day 30, the amount of Jackson's accounts receivable is:

A. $990,000

B. $900,000

C. $810,000

D. $450,000

-

Question 160:

Average daily cash outflows are $3 million for Evans Inc. A new cash management system can add two days to the disbursement schedule. Assuming Evans earns 10 percent on excess funds, how much should the firm be willing to pay per year for this cash management system?

A. $3,000,000

B. $1,500,000

C. $600,000

D. $150,000

Related Exams:

AACD

American Academy of Cosmetic DentistryACLS

Advanced Cardiac Life SupportASSET

ASSET Short Placement Tests Developed by ACTASSET-TEST

ASSET Short Placement Tests Developed by ACTBUSINESS-ENVIRONMENT-AND-CONCEPTS

Certified Public Accountant (Business Environment amd Concepts)CBEST-SECTION-1

California Basic Educational Skills Test - MathCBEST-SECTION-2

California Basic Educational Skills Test - ReadingCCE-CCC

Certified Cost Consultant / Cost Engineer (AACE International)CGFM

Certified Government Financial ManagerCGFNS

Commission on Graduates of Foreign Nursing Schools

Tips on How to Prepare for the Exams

Nowadays, the certification exams become more and more important and required by more and more enterprises when applying for a job. But how to prepare for the exam effectively? How to prepare for the exam in a short time with less efforts? How to get a ideal result and how to find the most reliable resources? Here on Vcedump.com, you will find all the answers. Vcedump.com provide not only Test Prep exam questions, answers and explanations but also complete assistance on your exam preparation and certification application. If you are confused on your BUSINESS-ENVIRONMENT-AND-CONCEPTS exam preparations and Test Prep certification application, do not hesitate to visit our Vcedump.com to find your solutions here.