Exam Details

Exam Code

:BUSINESS-ENVIRONMENT-AND-CONCEPTSExam Name

:Certified Public Accountant (Business Environment amd Concepts)Certification

:Test Prep CertificationsVendor

:Test PrepTotal Questions

:530 Q&AsLast Updated

:Apr 11, 2025

Test Prep Test Prep Certifications BUSINESS-ENVIRONMENT-AND-CONCEPTS Questions & Answers

-

Question 161:

The amount of inventory that a company would tend to hold in stock would increase as the:

A. Cost of carrying inventory decreases.

B. Variability of sales decreases.

C. Cost of running out of stock decreases.

D. Length of time that goods are in transit decreases.

-

Question 162:

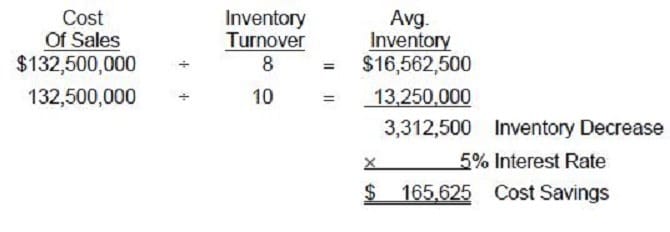

Spotech Co.'s budgeted sales and budgeted cost of sales for the coming year are $212,000,000 and $132,500,000 respectively. Short-term interest rates are expected to average 5 percent. If Spotech could increase inventory turnover from its current 8 times per year to 10 times per year, its expected cost savings in the current year would be:

A. $165,625

B. $331,250

C. $81,812

D. $250,000

-

Question 163:

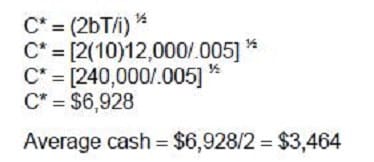

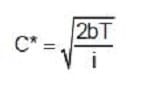

A company uses the following formula in determining its optimal level of cash.

Where: b = Fixed cost per transaction i = Interest rate on marketable securities T = Total demand for cash over a period of time

This formula is a modification of the Economic Order Quantity (EOQ) formula used for inventory management. Assume that the fixed cost of selling marketable securities is $10 per transaction, and the interest rate on marketable securities is 6 percent per year. The company estimates that it will make cash payments of $12,000 over a one-month period. What is the average cash balance (rounded to the nearest dollar)?

A. $1,000

B. $2,000

C. $3,464

D. $6,928

-

Question 164:

Which of the following factors is inherent in a firm's operations if it utilizes only equity financing?

A. Financial risk.

B. Business risk.

C. Interest rate risk.

D. Marginal risk.

-

Question 165:

Capital investments require balancing risk and return. Managers have a responsibility to ensure that the investments that they make in their own firms increase shareholder value. Managers have met that responsibility if the return on the capital investment:

A. Exceeds the rate of return associated with the firm's beta factor.

B. Is less than the rate of return associated with the firm's beta factor.

C. Is greater than the prime rate of return.

D. Is less than the prime rate of return.

-

Question 166:

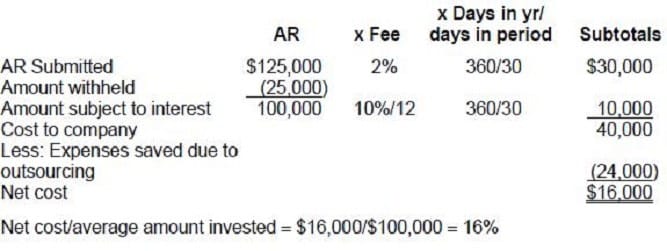

The Frame Supply Company has just acquired a large account and needs to increase its working capital by $100,000. The controller of the company has identified a source of funds which is given below:

Pay a factor to buy the company's receivables, which average $125,000 per month and have an average collection period of 30 days. The factor will advance up to 80 percent of the face value of receivables at 10 percent and charge a fee of 2 percent on all receivables purchaseD. The controller estimates that the firm would save $24,000 in collection expenses over the year. Assume the fee and interest are not deductible in advance. Assume a 360-day year in all of your calculations. The cost of factoring is:

A. 12.0 percent.

B. 14.8 percent.

C. 16.0 percent.

D. 20.0 percent.

-

Question 167:

Bander Co. is determining how to finance some long-term projects. Bander has decided it prefers the benefits of no fixed charges, no fixed maturity date and an increase in the credit-worthiness of the company. Which of the following would best meet Bander's financing requirements?

A. Bonds.

B. Common stock.

C. Long-term debt.

D. Short-term debt.

-

Question 168:

Which of the following formulas should be used to calculate the economic rate of return on common stock?

A. (Dividends + change in price) divided by beginning price.

B. (Net income - preferred dividend) divided by common shares outstanding.

C. Market price per share divided by earnings per share.

D. Dividends per share divided by market price per share.

-

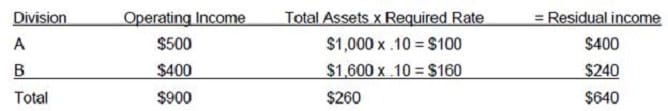

Question 169:

A company has two divisions. Division A has operating income of $500 and total assets of $1,000. Division B has operating income of $400 and total assets of $1,600. The required rate of return for the company is 10%. The company's residual income would be which of the following amounts?

A. $0

B. $260

C. $640

D. $900

-

Question 170:

At the beginning of year 1, $10,000 is invested at 8% interest, compounded annually. What amount of interest is earned for year 2?

A. $800.00

B. $806.40

C. $864.00

D. $933.12

Related Exams:

AACD

American Academy of Cosmetic DentistryACLS

Advanced Cardiac Life SupportASSET

ASSET Short Placement Tests Developed by ACTASSET-TEST

ASSET Short Placement Tests Developed by ACTBUSINESS-ENVIRONMENT-AND-CONCEPTS

Certified Public Accountant (Business Environment amd Concepts)CBEST-SECTION-1

California Basic Educational Skills Test - MathCBEST-SECTION-2

California Basic Educational Skills Test - ReadingCCE-CCC

Certified Cost Consultant / Cost Engineer (AACE International)CGFM

Certified Government Financial ManagerCGFNS

Commission on Graduates of Foreign Nursing Schools

Tips on How to Prepare for the Exams

Nowadays, the certification exams become more and more important and required by more and more enterprises when applying for a job. But how to prepare for the exam effectively? How to prepare for the exam in a short time with less efforts? How to get a ideal result and how to find the most reliable resources? Here on Vcedump.com, you will find all the answers. Vcedump.com provide not only Test Prep exam questions, answers and explanations but also complete assistance on your exam preparation and certification application. If you are confused on your BUSINESS-ENVIRONMENT-AND-CONCEPTS exam preparations and Test Prep certification application, do not hesitate to visit our Vcedump.com to find your solutions here.