Exam Details

Exam Code

:BUSINESS-ENVIRONMENT-AND-CONCEPTSExam Name

:Certified Public Accountant (Business Environment amd Concepts)Certification

:Test Prep CertificationsVendor

:Test PrepTotal Questions

:530 Q&AsLast Updated

:Apr 11, 2025

Test Prep Test Prep Certifications BUSINESS-ENVIRONMENT-AND-CONCEPTS Questions & Answers

-

Question 171:

The optimal capitalization for an organization usually can be determined by the:

A. Maximum degree of financial leverage (DFL).

B. Maximum degree of total leverage (DTL).

C. Lowest total weighted-average cost of capital (WACC).

D. Intersection of the marginal cost of capital and the marginal efficiency of investment.

-

Question 172:

The benefits of debt financing over equity financing are likely to be highest in which of the following situations?

A. High marginal tax rates and few noninterest tax benefits.

B. Low marginal tax rates and few noninterest tax benefits.

C. High marginal tax rates and many noninterest tax benefits.

D. Low marginal tax rates and many noninterest tax benefits.

-

Question 173:

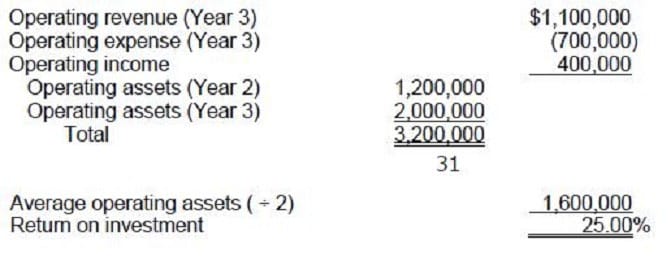

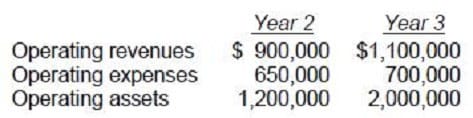

Vested, Inc. made some changes in operations and provided the following information:

What percentage represents the return on investment for year 3?

A. 28.57%

B. 25%

C. 20.31%

D. 20%

-

Question 174:

The capital structure of a firm includes bonds with a coupon rate of 12% and an effective interest rate is 14%. The corporate tax rate is 30%. What is the firm's net cost of debt?

A. 8.4%

B. 9.8%

C. 12.0%

D. 14.0%

-

Question 175:

What is the primary disadvantage of using return on investment (ROI) rather than residual income (RI) to evaluate the performance of investment center managers?

A. ROI is a percentage, while RI is a dollar amount.

B. ROI may lead to rejecting projects that yield positive cash flows.

C. ROI does not necessarily reflect the company's cost of capital.

D. ROI does not reflect all economic gains.

-

Question 176:

Which one of the following statements pertaining to the return on investment (ROI) as a performance measurement is incorrect?

A. When the average age of assets differs substantially across segments of a business, the use of ROI may not be appropriate.

B. ROI relies on financial measures that are capable of being independently verified while other forms of performance measures are subject to manipulation.

C. The use of ROI may lead managers to reject capital investment projects that can be justified by using discounted cash flow models.

D. The use of ROI can make it undesirable for a skillful manager to take on trouble-shooting assignments such as those involving turning around unprofitable divisions.

-

Question 177:

The basic objective of the residual income approach of performance measurement and evaluation is to have a division maximize its:

A. Return on investment rate.

B. Imputed interest rate charge.

C. Cash flows in excess of a desired minimum amount.

D. Income in excess of a desired minimum amount.

-

Question 178:

The imputed interest rate used in the residual income approach for performance measurement and evaluation can best be characterized as the:

A. Historical weighted average cost of capital for the company.

B. Average return on investment that has been earned by the company over a particular time period.

C. Average return on assets employed over a particular time period.

D. Average prime lending rate for the year being evaluated.

-

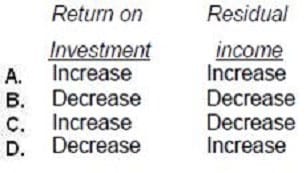

Question 179:

Minon, Inc. purchased a long-term asset on the last day of the current year. What are the effects of this purchase on return on investment and residual income?

A. Option A

B. Option B

C. Option C

D. Option D

-

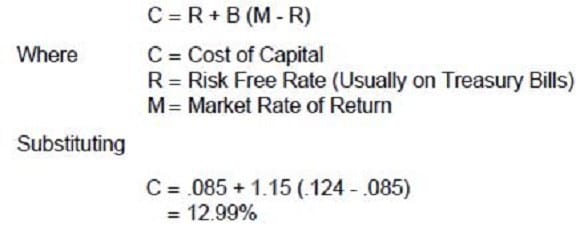

Question 180:

Colt Inc. is planning to use retained earnings to finance anticipated capital expenditures. The beta coefficient for Colt's stock is 1.15, the risk-free rate of interest is 8.5 percent, and the market return is estimated at 12.4%. If a new issue of common stock was used in this model, the flotation costs would be 7%. By using the Capital Asset Pricing Model equation C = R + B (M - R), the cost of using retained earnings to finance the capital expenditures is:

A. 13.96 percent.

B. 12.99 percent.

C. 14.26 percent.

D. 13.21 percent.

Related Exams:

AACD

American Academy of Cosmetic DentistryACLS

Advanced Cardiac Life SupportASSET

ASSET Short Placement Tests Developed by ACTASSET-TEST

ASSET Short Placement Tests Developed by ACTBUSINESS-ENVIRONMENT-AND-CONCEPTS

Certified Public Accountant (Business Environment amd Concepts)CBEST-SECTION-1

California Basic Educational Skills Test - MathCBEST-SECTION-2

California Basic Educational Skills Test - ReadingCCE-CCC

Certified Cost Consultant / Cost Engineer (AACE International)CGFM

Certified Government Financial ManagerCGFNS

Commission on Graduates of Foreign Nursing Schools

Tips on How to Prepare for the Exams

Nowadays, the certification exams become more and more important and required by more and more enterprises when applying for a job. But how to prepare for the exam effectively? How to prepare for the exam in a short time with less efforts? How to get a ideal result and how to find the most reliable resources? Here on Vcedump.com, you will find all the answers. Vcedump.com provide not only Test Prep exam questions, answers and explanations but also complete assistance on your exam preparation and certification application. If you are confused on your BUSINESS-ENVIRONMENT-AND-CONCEPTS exam preparations and Test Prep certification application, do not hesitate to visit our Vcedump.com to find your solutions here.